Shares of Western Digital Corp. (WDC) fell 1.6% in Wednesday’s extended trading session after the company provided an update on the production status of its joint venture flash memory manufacturing facilities and outlook for the third quarter of Fiscal Year 2022.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Western Digital engages in the development, manufacture, market and sale of data storage devices and solutions. It operates through client devices, data center devices and solutions, and client solutions product categories.

Production Update

The company said that both Yokkaichi and Kitakami joint venture flash fabrication facilities are producing at a normal level since late February 2022. The facilities had not been operational since early February due to the contamination of certain material used in its manufacturing processes.

Also, Western Digital said that its flash availability is expected to fall by about seven exabytes in the fiscal third and fourth quarters, as the facilities ramp back to full production output.

Q3 Outlook

For the third quarter of Fiscal 2022, Western Digital anticipates adjusted revenue between $4.20 and $4.40 billion versus the consensus estimate of $4.50 billion. Also, adjusted earnings are projected in the range of $1.30 to $1.60 per share, compared to analysts’ expectations of $1.62 per share.

Stock Rating

Following the news, Rosenblatt Securities analyst Kevin Cassidy maintained a Hold rating on Western Digital with a price target of $56, implying 8% upside potential from current level.

Cassidy said, “… reduced NAND Flash output has changed the supply/demand ratio from oversupply to undersupply. This changed expectations for NAND Flash prices to increase 5% – 10% in the June quarter rather than decline 5% – 10%.”

“Western Digital may only benefit somewhat by this price increase because the company may need to sell its higher cost/bit 2-bit/cell (MLC) devices to support strategic 3-bit/cell (TLC) customers,” he added.

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 9 Buys and 5 Holds. The Western Digital stock price prediction of $69.50 implies 34.1% upside potential to current levels.

Positive Sentiment

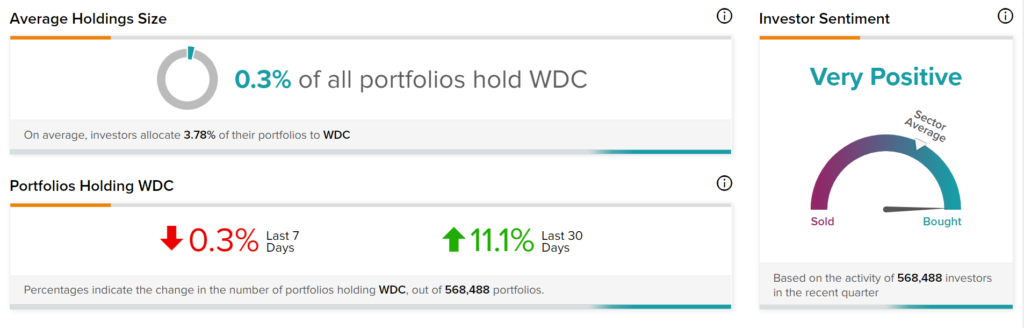

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Western Digital, as 11.1% of investors on TipRanks increased their exposure to WDC stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Victoria’s Secret Reports Better-Than-Expected Q4 Results

Plug Power Reports Mixed Q4 Results, Reaffirms 2022 Outlook

AbbVie Strengthens Neuroscience Portfolio with Syndesi Acquisition