Financial services giant Wells Fargo (NYSE:WFC) has received relief from its legal troubles, with the Office of the Comptroller of the Currency (OCC) terminating a consent order issued in 2016 against WFC. This order was related to misconduct in its sales practices. WFC stock closed 7.2% higher on Thursday, February 15.

WFC said OCC’s move signifies that the bank has significantly revamped its operations and has taken steps to protect its customers and employees. Further, it highlighted that this marks the sixth consent order regulators have terminated since 2019, which is a positive development.

Notably, Wells Fargo, in February 2020, agreed with the Department of Justice (DOJ) to resolve the criminal investigation into its retail sales practices. As part of resolving the investigations conducted by the Department of Justice (DOJ) and the Securities and Exchange Commission (SEC), WFC paid $3 billion in settlement.

Is Wells Fargo Stock a Buy, Sell, or Hold?

Wells Fargo continues to face several investigations into its business practices, posing a financial risk due to its track record of paying substantial penalties. However, the company has taken precautionary measures by creating provisions for potential legal proceedings against it.

Meanwhile, the company is executing well, witnessing improved growth and gaining market share. However, macro uncertainty keeps analysts cautiously optimistic.

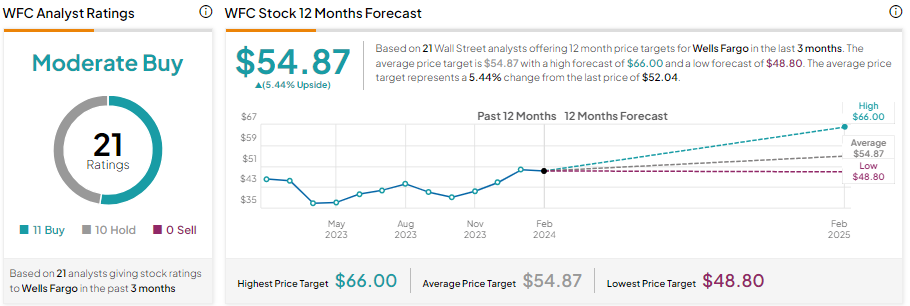

WFC stock has 11 Buys and 10 Holds for a Moderate Buy consensus rating. It has gained about 14% in one year. Analysts’ average price target of $54.87 implies 5.44% upside potential.