Shares of WELL Health Technologies Corp (WELL) fell more than 4% in early trading Tuesday despite the strong growth in revenues in the first quarter of 2021.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The omnichannel digital health company’s revenue for 1Q 2021 came in at C$25.6 million, an increase of 150% from the C$10.2 million revenue reported in 1Q 2020. WELL Health’s solid first-quarter performance was driven by its Software and Services 345% revenue growth year-over-year.

Meanwhile, adjusted EBITDA was C$0.5 million for 1Q 2021, compared to a loss in adjusted EBITDA of C$0.2 million for 1Q 2020. WELL Health’s Canadian operations provided a positive contribution to the results, achieving an adjusted EBITDA of C$1.1 million.

The company reported a net loss of C$7.1 million (C$-0.04 per share) in the first quarter, compared to a loss of C$2.0 million (C$-0.02 per share) in the same quarter a year earlier.

WELL Health’s Chairman and CEO Hamed Shahbazi said, “We are very pleased with our results from Q1-2021, in which quarterly revenue increased by 150% compared to the same period last year and we surpassed C$100 million annualized revenue run-rate. During Q1 we also announced the acquisition of CRH and subsequently closed the transaction in Q2, which puts us on track for an annualized revenue run-rate approaching $300 million. CRH accelerates our revenue growth and significantly boosts our free cash flow, which will be used to make additional cash flow generating acquisitions. I am also pleased to report that CRH, now operating as a stand-alone WELL business unit, is on track to meet its business plan goals to generate over US$150M in revenues and over US$40M in free cash flow before leverage and tax costs.” (See WELL Health Technologies Corp stock analysis on TipRanks.)

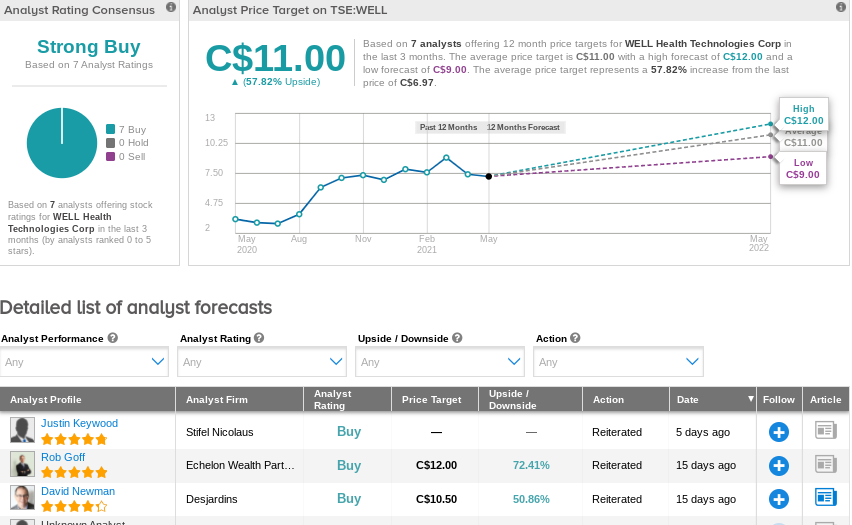

Two weeks ago, Echelon Wealth Partners analyst Rob Goff maintained a Buy rating on the stock with a C$12.00 price target for a 64.2% upside potential.

Overall, WELL Health stock scores a Strong Buy consensus rating based on 7 Buys. The average analyst price target of C$11.00 implies a 58% upside potential from current levels. Shares have more than doubled in value over the last year.

Related News:

WELL Health’s CRH Medical Acquires New England Anesthesia Associates

Jamieson Wellness Delivers Double-Digit Revenue Growth In 1Q

WELL Health Closes ExecHealth Acquisition