Stock Market and Economy Roundup

The beginning of the second quarter is greeting us with growing confusion, as different asset classes, as well as different S&P 500 sectors and even individual stocks’ performance trends, point in different directions. In March, we witnessed a surge in the spread between the best- and the worst-performing sectors while many of the largest money managers stayed on the sidelines, weakening market signals in either direction.

As the outlook for stocks now completely hinges on the Federal Reserve’s monetary action steps, which, in turn, are exclusively driven by economic data, each new economic report draws outsized attention and moves the market up or down, according to the outcome versus expectations. Meanwhile, the stress in the financial system is far from over, further distorting the outlook.

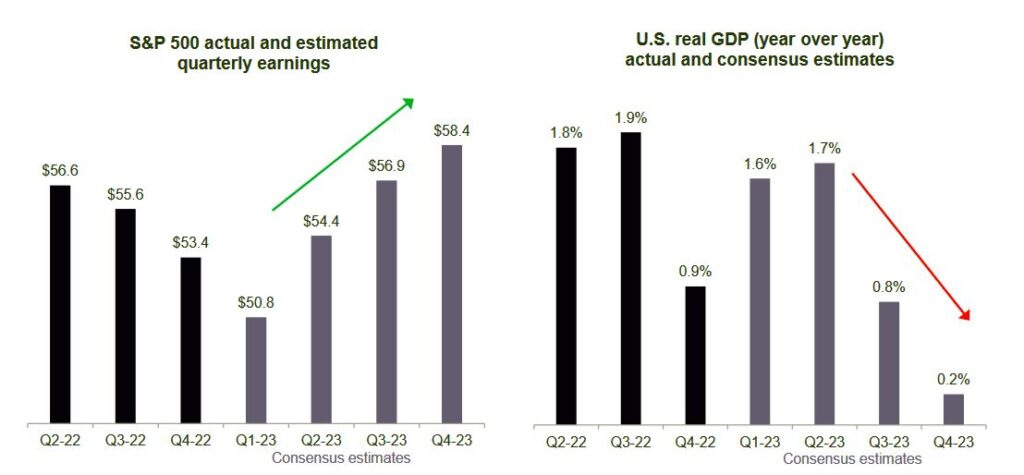

Unsure what to make of all this, analysts are slow in updating their earnings outlooks, while the economists are busy cutting their GDP growth forecasts.

–

Banking Troubles Not Resolved

The banking sector drama has subsided and is being pushed out of the headlines by the latest economic reports and the markets’ constantly changing assessment of how these datapoints may affect the Fed’s policy. However, the regional banks’ troubles are far from over. The smaller lenders are bleeding deposits, with some of them running away to the perceived safety of large banks, but with even more of the savers ditching banks altogether and moving to money market funds (MMFs), which are better than banks at passing along the Fed’s interest rate hikes to their clients. At a time when it’s possible to gain 4.5% p.a. basically risk-free in an MMF, many savers don’t see any reason to remain devoted to their banks, even if the Fed virtually pledged an all-deposit blanket guarantee.

Regional banks now have to compete harder for deposits; if they tried to do so by offering larger interest rates, that would further depress their profit margins. On the other hand, the deposit run isn’t only weighing on bank stocks, but on the economy as a whole. Smaller banks have been the main drivers of lending growth in the recent years. Even before last month’s banking drama, they were tightening their lending standards, while experiencing lower loan demand from businesses and individuals on the back of the softening of economic activity. As their deposits shrink – a process that isn’t expected to be reversed soon – lending will be squeezed even more, adding to the already acute strains on economic growth posed by the Fed’s rapid hikes.

–

Money on the Sidelines

Looking at the major indexes’ Q1 2023 performance, one might think that the stock market’s optimism has prevailed over the grim economic narrative. However, zooming into the details, it’s hard to remain optimistic.

U.S. stock ETFs registered their lowest investor money inflows since the beginning of the Covid-19 crisis, losing to bond ETFs and MMFs. Large money managers like Barclays (BCS) have gone underweight on U.S. stocks, cautioning that the Fed’s hikes will reverberate through the economy for a long time. At the same time, if the Fed is forced to cut interest rates, it wouldn’t be supportive for stocks as it would be brought on by much worse economic conditions than currently expected.

Equity investors became much pickier in the past quarter, preferring defensive sectors and large-cap companies. The narrowness of the recent stock rally, and particularly non-participation of the smaller stocks, defines it as a “bear-market rally” and portends more turbulence ahead. Simply put, the stock market as a whole will continue to search for direction as long as the economic picture remains unclear – and the unriddling of it will take some time. Of course, all this money sitting outside of stocks will ignite a great rally once they return; however, no one can predict when this might happen.

Meanwhile, Wall Street analysts have left their year-end targets for the S&P 500 unchanged for a third straight month in March, the longest period without target updates since 2005. With the abundance of market-influencing events in the near past and future, this lack of updates points at a complete confusion (which is also confirmed by the largest spread in two decades between the lowest and highest forecasts). With this level of market uncertainty, investors are advised to take precautions and base their decisions on trustworthy data and analysis.

–

Equities – Weekly Performance

The holiday-shortened week started with a shock, as OPEC+ decided on cutting oil output, boosting concerns about the inflationary impact of the oil price spike on the economy and the markets. However, the negative jolt to stock sentiment quickly subsided, as weaker-than-expected economic data hinted at a weaker economy, i.e., the Fed’s success in engineering a mild slowdown to bring down inflation.

What helped the stocks on Monday, depressed them on Tuesday: a report showing that job openings fell more than expected last month added to concerns about the economy (basically, questioning the “mildness” of the apparent slowdown). Meanwhile, JPMorgan (JPM) warned that the recent rally in risk assets is unsupported by the economic reality and that the stock markets will fall back to last year’s lows in the coming months.

On Wednesday, stocks continued their declines in thin trading, after a wave of weak economic data deepened worries that the Federal Reserve’s rapid interest rate hikes might have pushed the economy too far down.

However, the losses were quickly reversed on Thursday. Main U.S. indexes rose, closing the holiday-shortened week on a high note and clawing back some of their weekly losses. Technology and Communications stocks led the markets higher, as Treasury yields fell on new data on jobless claims, which added to the signs of a cooling labor market.

Indexes ended the week mixed, with the DJIA logging a small weekly gain and the S&P 500 and the Nasdaq Composite finishing in the red. The small-cap Russell 2000 index tumbled, underscoring a worsening outlook for the economy.

As trading reopens on Monday, markets will react to Friday’s unemployment and payroll reports, which sent mixed signals about the labor market. The market’s mood remains fragile; expect more turbulence ahead. Besides that, the Q1 2023 earnings season kicks off this coming week; investors will be on guard for signs of declining margins as well as for guidance for the rest of the year.

–

Major Economic Events of the Past Week

U.S.

March’s S&P/Markit Manufacturing PMI declined to 49.2 from February’s 49.3; it was expected to remain unchanged.

March’s ISM Manufacturing PMI fell to 46.3 from February’s 47.7; it was expected to decline to 47.5. Both PMI indicators point to an accelerating contraction in the U.S. manufacturing sector.

February’s Factory Orders fell by 0.7% from January’s -1.6% decline. The expectations were for a 0.5% decrease.

March’s ADP Employment Change slowed to +145K from February’s +261K; the expectations were for an increase of 200K.

March’s S&P/Markit Services PMI fell to 52.6 from February’s 53.8 versus the expectations of no change; the decline pointed at a slower expansion in the services sector.

ISM Services PMI also countered the expectations, falling to 51.2 vs. forecasts of 54.5, from February’s 55.1.

Initial Jobless Claims for the week ending April 1st came in at 228K versus the expected 200K. Continuing Jobless Claims for the week ending March 24th were at 1.823M, higher than the expected 1.699M.

March’s Unemployment Rate fell to 3.5% from February’s 3.6%. Non-Farm Payrolls came in at 236K, a little weaker than the expected 240K and considerably lower than February’s 326K. The Labor Force Participation Rate rose to 62.6% from February’s 62.5%. Average Hourly Earnings rose 4.2% year-on-year, their slowest since June 2021, versus the forecasted 4.3%. Average Weekly Hours fell to 34.4 from February’s 34.5. All in all, the reports showed that the labor market is moderating, but not as fast as the Fed would like it to, which gives grounds to the expectations of another rate hike in May.

–

Eurozone

March’s S&P/Markit Services PMI fell to 55 from February’s 55.6 versus the expectations of no change; the decline indicated that the ECB’s rate increases are now starting to depress the service sector activity.

March’s S&P/Markit Manufacturing PMI rose to 47.3 from February’s 47.1, pointing at a slower contraction in the sector.

–

Canada

March’s Unemployment Rate remained unchanged from February’s 5%, versus the expected increase to 5.1%.

March’s S&P/Markit Manufacturing PMI fell to 48.6 from February’s 52.4, as the activity in Canada caught up with the global manufacturing contraction.

March’s Ivey PMI (s.a.) jumped to 58.2 from February’s 51.6, higher than analysts’ forecast of 56.1, pointing at a much stronger economic activity than previously thought. However, keeping in mind the sharp slowdown in the country’s manufacturing, belatedly matching a global trend, Canada’s economy may not display this level of resilience for long.

–

Japan

Q1 2023 Tankan Large Manufacturing Index, which captures large manufacturers’ business conditions and serves as an indicator for overall economy, fell to 1 from Q4 2022’s level of 7.

February’s Overall Household Spending, which reflects the country’s level of consumer optimism, rose 1.6% year-on-year from January’s -0.3%; it was expected to increase by 4.3%.

–

China

March’s Markit/Caixin Manufacturing PMI declined to 50 from February’s 51.6, versus the expectations of an increase to 51.7. Markit/Caixin Services PMI surged to 57.8 from February’s 55, compared with the expected decline to 54. The figures point to an accelerating growth in the services sector, while manufacturing expansion stalled last month.

–

Stock Highlights of the Past Week

This past week the markets reacted to a number of earnings reports, with the most prominent of them being Levi Strauss & Co.

» Acuity Brands (AYI) reported mixed results for fiscal Q2 2023 (ended Feb. 28, 2023), with revenues falling short of analysts’ forecasts and earnings beating estimates. Markets initially brushed off the revenue miss; however, broad pessimism towards industrials prevailed and the stock tumbled on the week.

» Conagra Brands (CAG) shares jumped after the packaged food company reported revenue and earnings beat in fiscal Q2 2023, and upwardly revised guidance for FY 2023. J.P. Morgan and UBS raised their price target on the stock.

» Constellation Brands (STZ), a producer of alcoholic beverages, reported an earnings beat for the fourth quarter of 2023; however, revenue was below estimates. The company has raised its dividend by about 11%; however, what caught investors’ eyes was a revenue miss, and the stock fell modestly on the week.

» Levi Strauss & Co (LEVI) shares dropped 16.5% on the week despite earnings and revenue beat in the last quarter. The company guided for a cautious outlook in FY23, with projected revenues and EPS on the lower side of analysts’ expectations range. In addition, the apparel producer reported a noticeable contraction in profit margins, as well as stubbornly high, albeit declining, inventories.

» » Our Star of the Week is Alphabet (GOOGL), which surged 7.5% in 4 trading days, beating its sector (Communication Services) performance on the week, in the past month and year-to-date. Investors cheered the company’s announcement that it will integrate conversational AI features into the company’s flagship search engine, which is expected to make Google Search faster and smarter, as well as help Google in its competition with ChatGPT AI advancement, funded by Microsoft (MSFT).

–

Upcoming Economic Calendar Events

This week we’ll see published a number of very important reports, in both the U.S. and global markets.

February’s Wholesale Inventories, published on Monday, will give another hint about the state of the economy. On Tuesday, March’s NFIB Business Optimism Index will reveal the current small business conditions. On Wednesday, the main news will be March’s CPI and CPI ex. Food & Energy (Core CPI). March’s Producer Price Inflation (PPI) on Thursday will help produce the outlook for short-term consumer inflation. Finally, on Friday, we’ll receive readings on March’s Retail Sales, March’s Industrial Production, and preliminary data on April’s Michigan Consumer Sentiment Index.

Elsewhere, this week we’ll get reports on Eurozone’s March Retail Sales and February’s Industrial Production; China’s March CPI and PPI; Bank of Canada’s interest rate decision; and U.K.’s February GDP Growth.

Current and scheduled economic reports, Fed statements, and other releases, as well as their level of impact on stock markets, can be found on the TipRanks Economic Calendar.

–

Upcoming Earnings and Dividend Announcements

The Q1 2023 season has begun; there are some important reports coming out this week. As usual, the season begins with the banks and other financials; but there are also some non-financial companies scheduled to dispatch their financial results in the coming days.

The most anticipated releases outside of financials are those of Delta Air Lines (DAL), Infosys (INFY), Albertsons Companies (ACI), CarMax (KMX), Progressive (PGR), and UnitedHealth (UNH).

On Friday, the banks’ reports deluge starts in earnest, with Blackrock (BLK), Citigroup (C), JPMorgan Chase & Co. (JPM), Wells Fargo (WFC), and PNC Financial (PNC).

Noticeably absent from this list is the First Republic Bank (FRC), who was for many years among the early banks to report. This quarter, the earnings call is scheduled for April 24 – and that is sooner than the analysts expected, given that the lender was just rescued from oblivion by JPMorgan et al. The bank said it will suspend payments of quarterly cash dividends on its preferred stock, after the suspension of dividends on its common stock last month. The markets are expecting bad news to come from the lender’s report; stay tuned for updates.

Companies’ reporting dates, consensus EPS forecasts and past data, together with their analyst ratings and price targets, can be found on the TipRanks Earnings Calendar.

This week’s Ex-Dividend dates are coming for the payouts of Dollar General (DG), Oracle (ORCL), UBS Group AG (UBS), AbbVie (ABBV), American Tower (AMT), Foot Locker (FL), Acuity Brands (AYI), General Dynamics (GD), and other dividend-paying firms.

Companies’ Ex- and Payment dates, together with their analyst ratings and price targets, can be found on the TipRanks Dividend Calendar.