The broader U.S. stock market averages gained more than 1% across the board on Friday, as the S&P 500 rallied for a fourth consecutive week.

Energy names led the way higher, as investors took solace that the latest inflation data were not as bad as feared.

On Wednesday, it was reported that core July consumer prices (CPI) increased 5.9% from a year ago, excluding food and energy. This figure was the same as the previous month and lower than expected.

The next day, it came out that core producer prices (PPI) were up 7.6% in July; showing a deceleration from the previous month and falling short of estimates.

The Week Ahead

Retail names headline the reporting calendar this week, beginning with Home Depot (HD) and Wal-Mart (WMT) on Tuesday. Cisco Systems (CSCO) and Lowe’s (LOW) are scheduled for Wednesday, while Deere (DE) reports Friday.

On the economic front, we’ll get some looks at the state of the U.S. housing market throughout the week. Wednesday brings the July retail sales report, in addition to the minutes of the latest FOMC meeting.

Given a slowing growth outlook and the prospect of higher interest rates, it could become hard to come by investment gains in 2022. As a result, deciding what and when to buy can be challenging for any investor.

However, the fact remains that investments with upside potential and other positive signals are out there if you dig a little deeper.

One such Energy name worth a closer look at is our Stock of the Week.

Stock of the Week: Matador Resources (MTDR)

The company explores and produces energy commodities, focusing on oil and natural gas shale in the Delaware Basin.

The stock gained 14% last week. It is showing signs that it has the potential to continue this relative outperformance into the final months of 2022. Here’s why:

Matador is carrying a lot of operating momentum, as was evident when it posted better-than-expected quarterly results in July. The company earned $3.47 a share in the second quarter, as revenue grew by 164% from the previous year to $943.9 million.

Upside in the period was driven by 18% sequential production growth. Matador also paid down more than $200 million of debt.

In the meantime, the stock appears inexpensive at just 5.7x profit expected over the next four quarters. This is a discount to both the broader market and the company’s expected annual earnings growth rate.

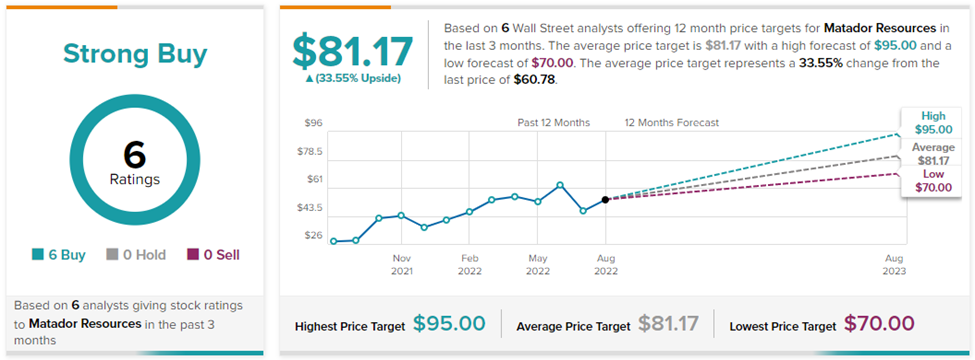

Wall Street agrees that Matador is attractively valued at current levels. All six analysts tracked by TipRanks rate the shares a Buy. Their average price target of $81.17 represents 33.6% upside potential.

In the meantime, the company carries an “Outperform” Smart Score of 10/10 on TipRanks. This data-driven stock score is based on 8 key market factors.

On top of the positive aspects mentioned already, the Smart Score indicates that shares have seen improving sentiment from hedge funds and financial bloggers.

FYI: This is just 1 of the 20+ stocks selected for the Smart Investor portfolio, a weekly newsletter that blends big data, and market insights.