Lauren Taylor Wolfe, the managing partner at Impactive Capital, says that the current wave of excitement around AI is a bubble that will eventually burst. In an interview with CNBC, she compared today’s AI craze to the dot-com boom of the late 1990s. “We are absolutely in an AI bubble now. It is going to burst. I don’t know when. I don’t know the order of magnitude. A lot of people are going to lose money,” she said. Wolfe believes that many investors are getting swept up in the hype and may end up with losses when the market corrects.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As an example of current market excess, she pointed to Oklo (OKLO), which is a nuclear energy company backed by Sam Altman. “It is the largest weight in the Russell 2000 Value index (IWN). It has no revenues for three years… Today, it’s $25B of market cap with no revenues,” she said, describing the situation as “insane.” Instead of chasing trends, Wolfe takes a long-term investment approach. She looks for strong companies that are misunderstood or undervalued and works with them to help close the gap between their current market value and their true worth.

Wolfe recommends looking at sectors that others are ignoring, just like during the dot-com bubble. “You’d be better off owning a railroad in 2000 than buying Cisco (CSCO) at 35x earnings,” she explained. Although she agrees AI will have a major impact on the economy and that companies like Google (GOOGL) could benefit, she questions whether the current level of investment makes financial sense. Wolfe argued that the trillions being invested in AI far outweigh the hundreds of billions in free cash flow produced by the Mag 7, making it unrealistic to expect matching profits in the next five years.

Is QQQ Stock a Good Buy?

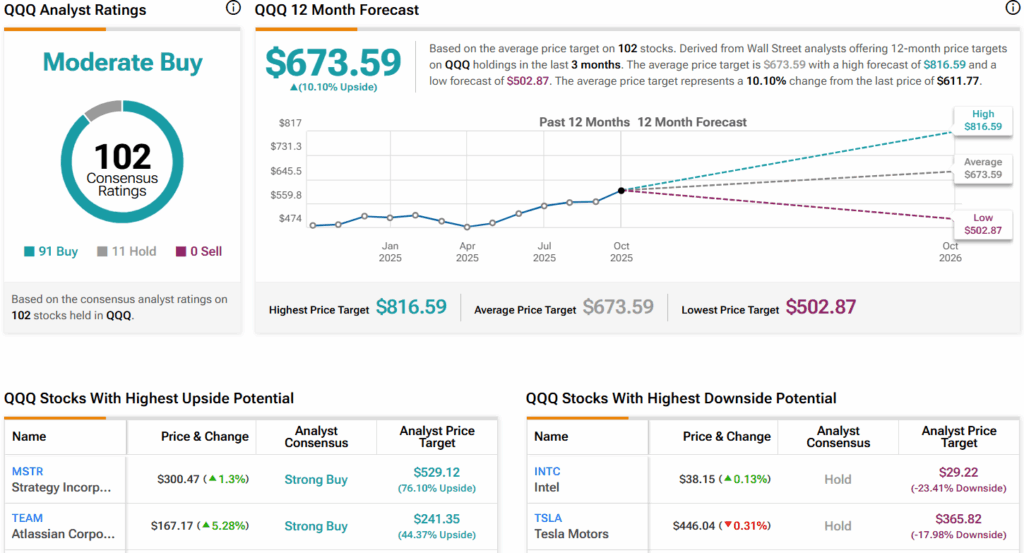

Turning to Wall Street, analysts have a Moderate Buy consensus rating on the Nasdaq-tracking Invesco QQQ Trust (QQQ) ETF based on 91 Buys, 11 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average QQQ price target of $673.59 per share implies 10.1% upside potential.