A record number of global fund managers now believe that artificial intelligence stocks are in a bubble, according to Bank of America’s (BAC) October survey. In the poll, 54% of global fund managers said that tech stocks look too expensive, which is double the number who said so just last month. Worries about global stock valuations also hit a new high, which indicates that investors are becoming increasingly cautious about how much prices have climbed.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nevertheless, U.S. stocks have continued to rise due to the hype surrounding AI and the boost it could bring to productivity. For instance, the Nasdaq 100 (QQQ), which includes many major tech companies, is up 18% on a year-to-date basis. In addition, its forward price-to-earnings ratio is now nearly 28, compared to a 10-year average of 23. As a result, some are questioning whether tech stocks are rising too fast relative to their actual earnings. Despite these concerns, fund managers are still putting more money into U.S. stocks and have now reached the highest exposure level in eight months.

At the same time, recession worries have dropped to their lowest since early 2022. Cash holdings have gone down, too, but Bank of America strategist Michael Hartnett said that lingering concerns about AI and private credit markets are holding back full optimism. Other risks weighing on investors include rising U.S.-China tensions, inflation, fears that the Fed may lose independence, and worries about the weakening dollar. It is worth noting that the survey was conducted between October 3 and 9, with 166 fund managers who oversee $400 billion in assets.

Is QQQ Stock a Good Buy?

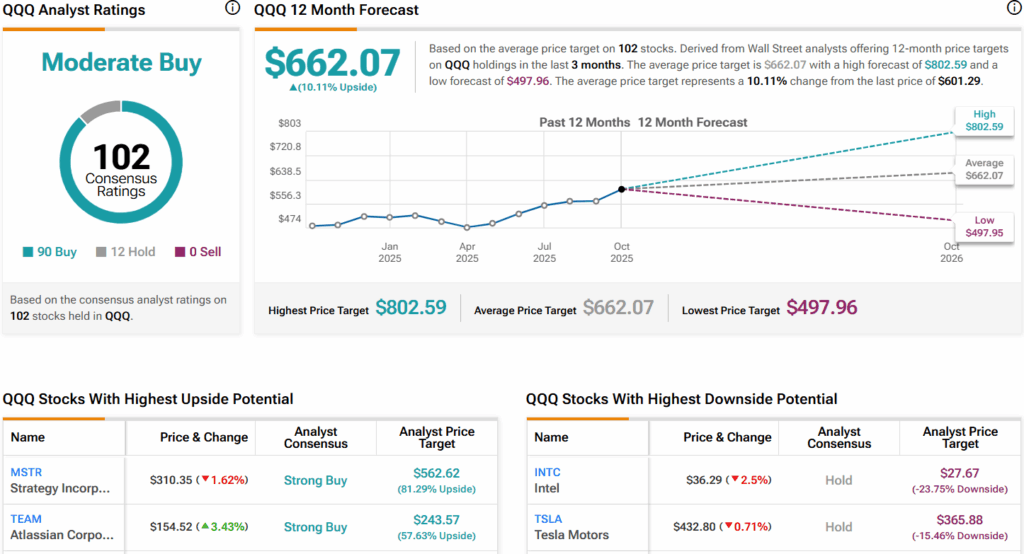

Turning to Wall Street, analysts have a Moderate Buy consensus rating on QQQ stock based on 90 Buys, 12 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average QQQ price target of $662.07 per share implies 10.1% upside potential.