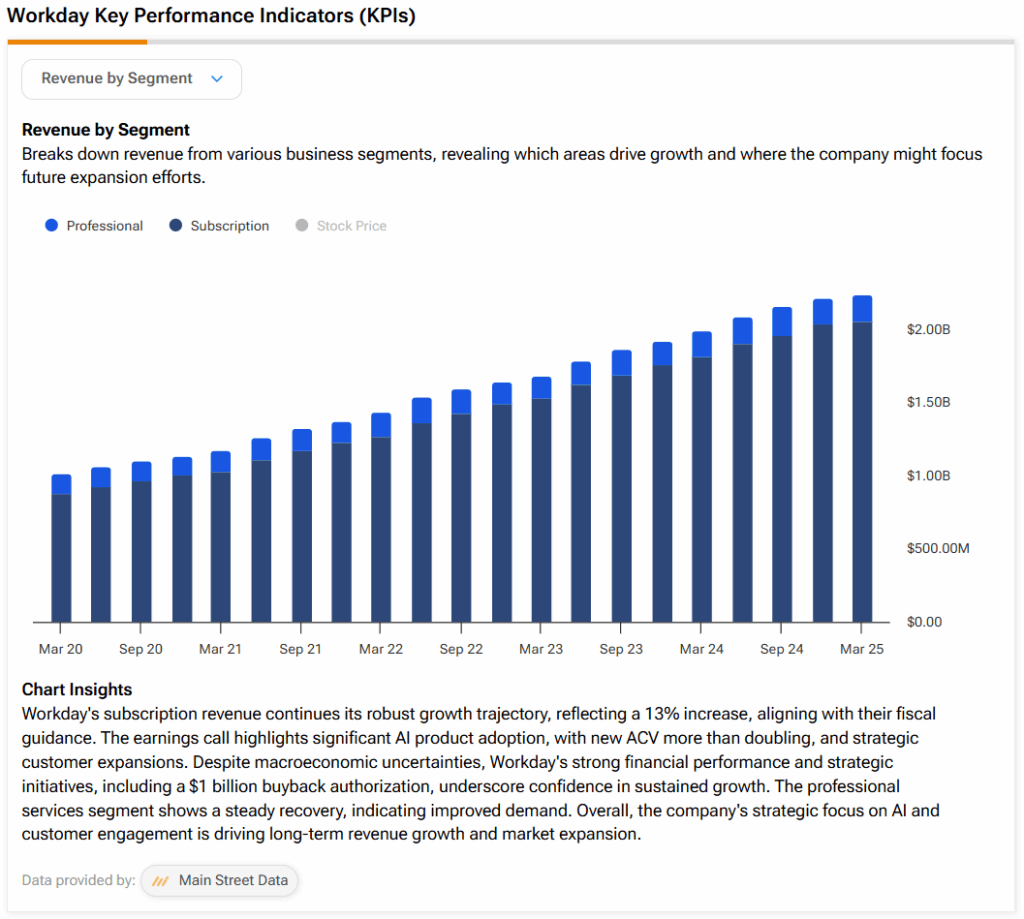

Shares of Workday (WDAY) were little changed in after-hours trading after the software company reported earnings for its second quarter of Fiscal Year 2026. Earnings per share came in at $2.21, which beat analysts’ consensus estimate of $2.12 per share. In addition, sales increased by 12.6% year-over-year, with revenue hitting $2.35 billion and subscriptions making up $2.169 billion of the total. This beat analysts’ expectations of $2.34 billion. This continues Workday’s trend of steady revenue growth over the past several years, as shown in the picture below.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Furthermore, Workday reported a 16.4% year-over-year increase in its 12-month subscription revenue backlog to $7.91 billion, while its total subscription revenue backlog rose 17.6% to $25.37 billion. The company also repurchased approximately 1.2 million shares of Class A common stock for $299 million under its share buyback programs.

Separately, Workday has agreed to acquire Paradox, which is a company that uses conversational AI to improve the hiring process, especially for high-volume, frontline jobs. By integrating Paradox into its platform, Workday hopes to help companies hire faster and more efficiently. Interestingly, Paradox has powered over 189 million AI-driven candidate conversations and cut time-to-hire to as little as 3.5 days. The acquisition is expected to close in Q3 of Workday’s Fiscal Year 2026, pending regulatory approval, and is seen as a strategic move to expand Workday’s reach in AI-driven talent acquisition.

Guidance for FY 2026

Looking forward, management has provided the following guidance for FY 2026:

- Subscription revenue of $8.815 billion compared to the previous outlook of $8.8 billion

- Non-GAAP operating margin of 29% compared to analysts’ estimates of 28.5%

As we can see, the company’s subscription revenue outlook came in higher than its previous guidance range, which likely led to the after-hours move in the stock price.

Is Workday a Good Stock to Buy?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WDAY stock based on 22 Buys, eight Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average WDAY price target of $289.21 per share implies 27.05% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.