Manufacturer of household and multi-use products company WD-40 (NASDAQ:WDFC) soared in trading on Wednesday as it reported strong first-quarter results. The company’s total Q1 net sales were $140.4 million, an increase of 12% year-over-year, and were above consensus estimates of $138.2 million.

The company reported Q1 diluted earnings of $1.28 per share compared to $1.02 per share in the same period last year and surpassed Street estimates of $1.045 per share.

WD-40 declared a quarterly dividend of $0.88 per share, up by 6% from the previous quarter’s dividend of $0.83, payable on January 31 to shareholders of record on January 19, 2024.

The company reiterated its FY24 guidance and continues to expect adjusted net sales between $570 million and $600 million, with growth projected to be in the range of 6% to 12% on a constant currency basis. Diluted earnings are projected to be between $4.78 and $5.15 per share in FY24.

Is WD-40 a Buy or Sell?

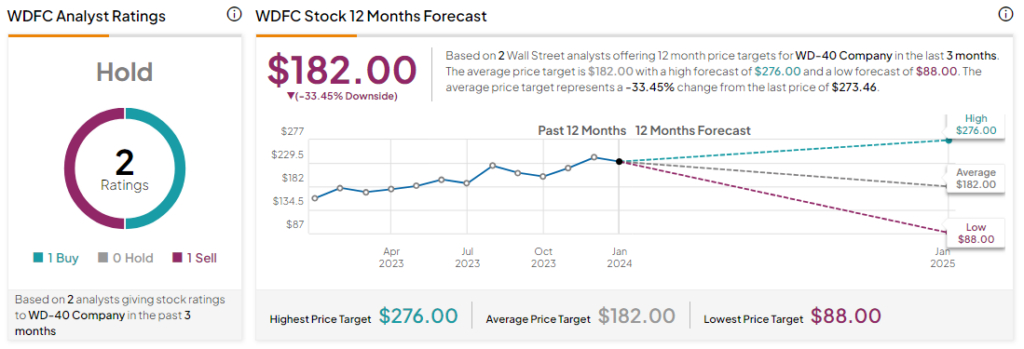

Analysts are sidelined about WDFC stock with a Hold consensus rating based on one Buy and one Sell. Over the past year, WD-40 has surged by more than 70%, and the average WDFC price target of $182 implies a downside potential of 33.5% at current levels.