Warren Buffett‘s Berkshire Hathaway (BRK.A) (BRK.B) has halved its stake in information technology company HP (NYSE:HPQ) to 5.2%. It now holds 51.5 million shares worth around $1.56 billion as of November 30.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This is the second consecutive quarter that Berkshire Hathaway has pulled back from HP. The holding company has been unloading HP for some time now, mainly because it’s pulling out of the personal computing and printer market.

In addition, it’s worth noting that corporate insiders seem to be negative about HPQ stock and have sold $619.8 million worth of shares over the past three months.

Is HPQ a Buy or Sell?

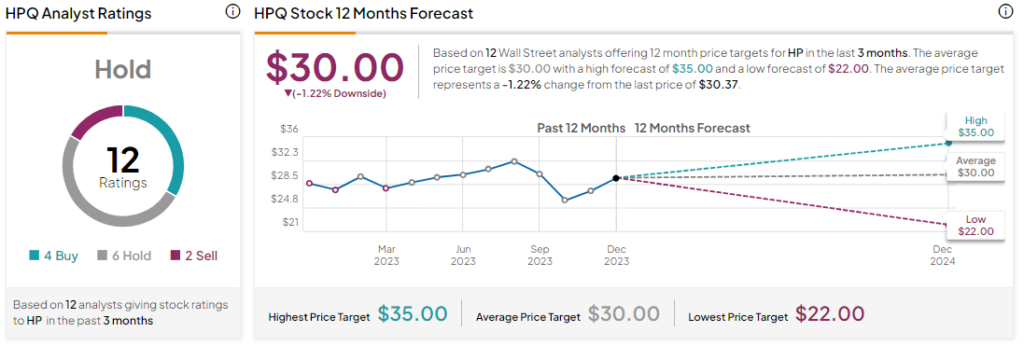

Analysts remain sidelined about HPQ stock with a Hold consensus rating based on four Buys, six Holds, and two Sells. In the past year, HPQ stock has increased by more than 8%, and the average HPQ price target of $30 implies a downside potential of 1.22% at current levels.