Sometimes the market turns against even the greats, like the Wizard of Omaha himself, Warren Buffett. Because Warren Buffett—at least, his Berkshire Hathaway (NYSE:BRK.B) company—has been selling HP stock (NYSE:HPQ) hand over fist. Despite this huge sell-off, investors are still coming in, and HP stock was up over 2% in Tuesday afternoon’s trading.

Berkshire Hathaway has been pulling back on its involvement with HP for some time now, mostly because it’s pulling out of the personal computing and printer market. That’s pretty much HP’s entire stock in trade, so that was mostly it for Berkshire Hathaway. However, it’s not pulling out altogether, but rather scaling back; Berkshire currently holds just under 101 million shares of HP stock, worth a combined total of about $2.6 billion.

This news actually comes at an odd time. While Berkshire Hathaway is pulling back on the PC and printer markets, Bank of America actually upgraded HP stock to a Buy. That’s up from Underperform just a few days ago, as Bank of America analyst Wamsi Mohan jumped the rating up. Mohan noted that the market for PCs is likely to take off again, which would bring along with it an accompanying demand for printers. Granted, PC demand was sluggish for a while, as buyers pulled demand forward during the pandemic. But new estimates from IDC say PC shipments will likely grow in 2024.

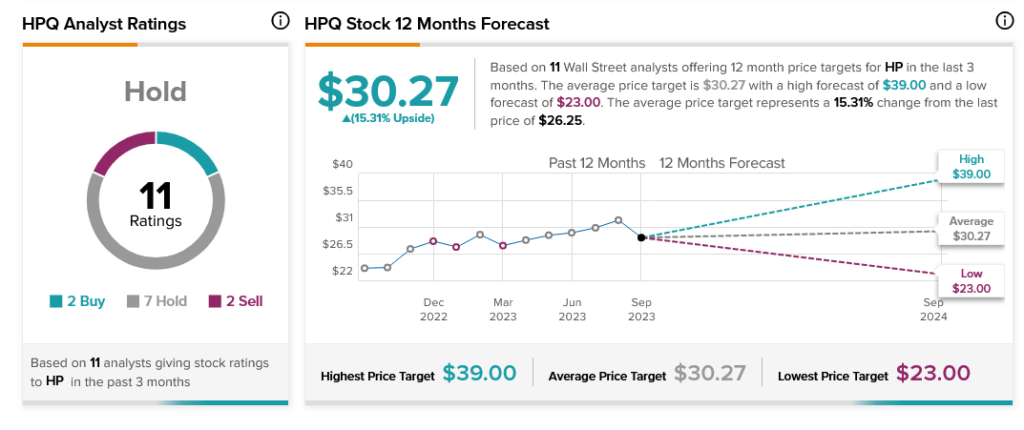

Is HPQ a Buy, Sell, or Hold?

Analysts in general, however, are a bit more skeptical. HP stock currently has two Buy ratings, two Sell, and seven Hold, making HP stock a consensus Hold. Further, HP stock offers investors a 15.31% upside potential thanks to its average price target of $30.27.