Remember how we said, not so long ago, that because entertainment giant Warner Bros. Discovery (WBD) expected to conclude its sale process before Christmas, things were going to have to move quickly? Well, we just got proof of that a little while ago. Comcast (CMCSA) has officially thrown its hat in the ring, and is getting bankers together to construct a bid for control of Warner. The news was good enough for Warner investors, who sent its shares up fractionally in the closing minutes of Friday’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Not only did Comcast bring in a set of bankers to help put the deal together, but Warner has also opened up access to at least some of the books, which are required matter to put together a proper offer. Comcast’s president, Mike Cavanagh, has been on record previously saying that Comcast was looking into media assets that “…would be complementary to our existing business.”

Interestingly, Cavanagh also had a thing or two to say about those who are skeptical that a Comcast / Warner deal would run into problems at the regulatory level. Cavanagh noted there, “…more things are viable than maybe some of the public commentary that’s out there.” That does not mean much by itself, but it does suggest that Cavanagh has at least consulted with somebody about the matter to have at least some idea a deal could go through.

The Story so Far

The idea that this is going to ultimately turn into a bidding war, as Warner CEO David Zaslav was hoping all along, seems to be coming together. We know that Paramount Skydance (PSKY) has put multiple bids out. We know that Netflix (NFLX) was getting a bid together. And now, we have Comcast in play.

We also know that Apple (AAPL) is out of the running, having pulled itself off that particular track a few weeks ago. There are even some signs that Amazon (AMZN) may throw its hat in the ring before too much longer. And there is always the possibility that Warner will eschew all bids altogether in favor of the corporate split into Discovery Global and Warner Bros.

Is WBD Stock a Good Buy?

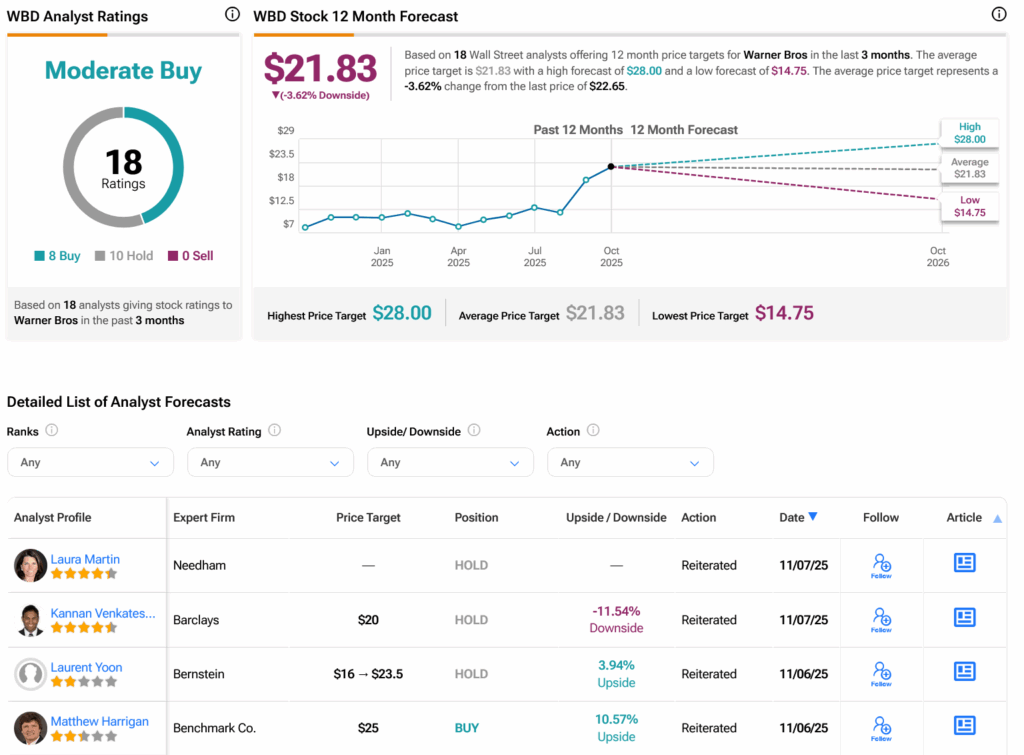

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on eight Buys and 10 Holds assigned in the past three months, as indicated by the graphic below. After a 144.23% rally in its share price over the past year, the average WBD price target of $21.83 per share implies 3.62% downside risk.