It seems, right now, that the front-runner for buying entertainment giant Warner Bros. Discovery (WBD) is equally giant Paramount Skydance (PSKY). But there are growing concerns about such a merger, particularly in terms of how the two firms have addressed politics in the past. It seems investors are a bit concerned as well, as they sent Warner shares down fractionally in the closing minutes of Wednesday’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The big concern right now, one report expressed, is a matter of journalistic integrity. The report notes that Paramount Skydance basically worked to appease the Trump administration to begin with; some even question if it would be Paramount Skydance today if it were not for the seeming acquiescence. But if Paramount bought Warner, then that would be not only CBS News, but also CNN, under the control of such principles.

While politics is a generally subjective matter, it is likely that regulators would have an issue with CNN and CBS being under the same umbrella. While it could be addressed—Warner could sell off CNN, or leave CNN in Discovery Global’s care once it splits off, as some believe will happen before anyone can launch a buyout attempt—that point would likely be the point where regulators rebel. However, if Warner were bought by Netflix (NFLX) instead, the CNN issue would effectively fall apart.

“Online Multiplayer RPG”

Warner’s gaming tenure has been, perhaps, checkered. While it gave us the disaster that was Suicide Squad: Kill the Justice League, it also gave us the joy that was Hogwarts Legacy. And now, reports note that Warner may be going back to that well as it, and Avalanche Software, are looking for a few good programmers to get an “online multiplayer RPG” off the ground.

There is nothing saying that this will be a Hogwarts Legacy sequel, though given how well the first one did—despite the controversy that surrounded it at launch—it is a safe bet we will see more. Plus, demand for Potter content is doing particularly well right now as a new series prepares to land in 2027. So with these two points in tandem, suggesting Warner is going back to the well is perfectly reasonable.

Is WBD Stock a Good Buy?

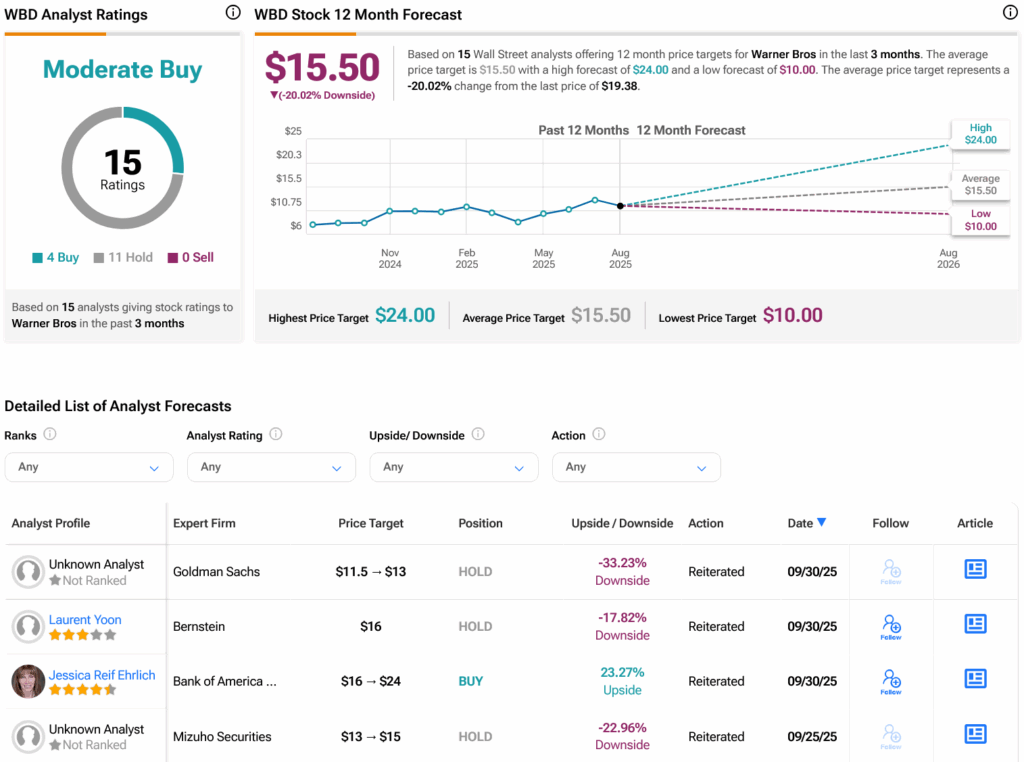

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on four Buys and 11 Holds assigned in the past three months, as indicated by the graphic below. After a 145.04% rally in its share price over the past year, the average WBD price target of $15.50 per share implies 20.02% downside risk.