Give entertainment leader and streaming giant Warner Bros Discovery (NASDAQ:WBD) credit; they’re not resting on their collective laurels. In fact, they’re working on some significant new expansion plans that will see their brand break into more geographical locations and content frontiers. Investors, however, weren’t really enthused about the plan, sending Warner down over 2.5% in the closing minutes of Friday’s trading session.

One of Warner’s biggest new pushes is in an unexpected field: anime. A report from Variety revealed that Warner has an anime studio in Japan already, which is producing five to 10 anime series a year. That’s not bad, but Warner wants to increase that figure to “more than 10” per year and has already improved expansion efforts to make that happen.

Warner anime includes a Batman installment featuring Batman as a ninja and the iconic JoJo’s Bizarre Adventure series. Reports note that a Suicide Squad series is set to follow as well.

The Expansion Efforts Don’t End There

The expansion efforts don’t end there, either. Warner recently announced that its Max streaming service would go live starting May 21, hitting large portions of Europe. The rollout will continue until June 17, when most of Europe will have access to the platform. Finally, reports emerged about the upcoming sports streaming package between Fox (NYSE:FOXA), Disney (NYSE:DIS), and Warner. The new package is set to run between $40 and $50 monthly, noted The Athletic. However, reports note that this is a tentative number that could increase later.

Is FedEx Stock a Good Buy?

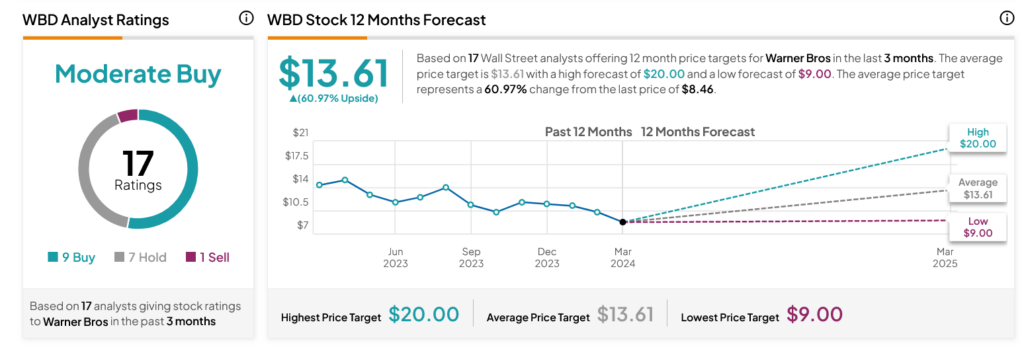

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on nine Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 41.53% loss in its share price over the past year, the average WBD price target of $13.61 per share implies 60.97% upside potential.