Entertainment giant Warner Bros. Discovery (WBD) has drawn a lot of investor interest lately, especially with the potential that it might end up merged with Paramount Skydance (PSKY). Or possibly with Netflix (NFLX), if the reports hold true. That in turn pushed Warner over a record high for a while. It is down slightly from that high, but still up over 1.5% in the closing minutes of Monday’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Warner recently hit the 52-week high of $19.60 per share, which represented what reports called “…a significant upturn in the company’s market performance over the past year.” Reports also suggested shares were trading at “fair value,” which suggests the rally may have legs after all, despite concerns that if the merger interest fades, so too will the raised share price.

A solid financial standing and market position also helped, as well as “…strategic initiatives and successful content releases that have bolstered the company’s financial standing and market position.” But it is the incoming interest from two other media giants in the field that might have produced the most interest of all in Warner in recent days.

Just How Interested

A new report actually underscores just how much interest there may ultimately be in Warner. A deal between Netflix and Warner, reports noted, could ultimately value Warner at “…upwards of $40 billion,” thanks to Warner’s massive intellectual property folder.

Indeed, Warner has a lot to draw a company like Netflix. Start with massive and established production facilities, the kind Netflix itself has only recently been spotted starting to set up with Netflix Studios Fort Monmouth. From there, branch out to a vast library of property, including not only Warner’s own content, but things like the entire DC universe and DC Animated Universe. Throw in the fact that a deal between Warner and Paramount is already starting to spook regulators, and Warner selling out to Netflix looks like a very real possibility.

Is WBD Stock a Good Buy?

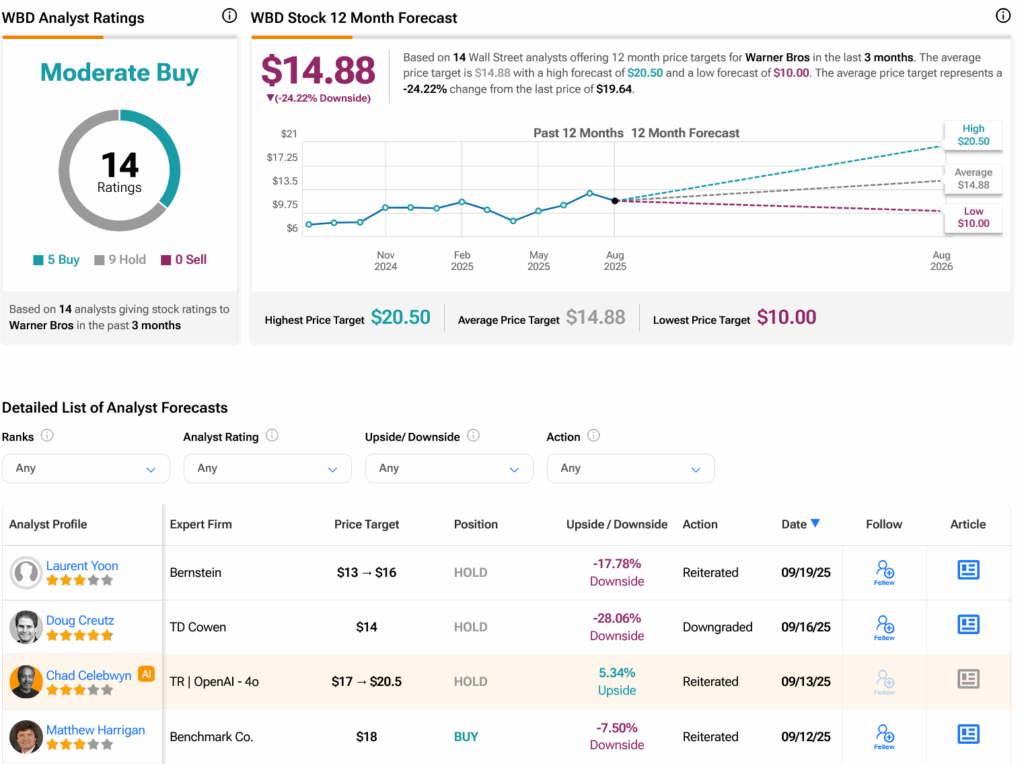

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on five Buys and nine Holds assigned in the past three months, as indicated by the graphic below. After a 136.89% rally in its share price over the past year, the average WBD price target of $14.88 per share implies 24.22% downside risk.