Last week, the big-box retailer Walmart (NYSE:WMT) sued Capital One Financial (NYSE:COF) to end its credit-card partnership, The Wall Street Journal reported. Walmart has made claims that Capital One was unable to meet customer care standards.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

According to the lawsuit, the credit card company failed to promptly update cardholders’ accounts with payment information and also did not replace lost cards within five days.

In its defense, Capital One said that it aims to protect its contractual rights in court. Additionally, the company claimed that by filing the lawsuit, Walmart is trying to renegotiate the terms of the agreement or terminate it early, which is otherwise set to expire in 2026.

It’s interesting to note that Walmart intends to work with its fintech division to issue cards and that it anticipates launching a new card soon.

Is WMT a Good Stock?

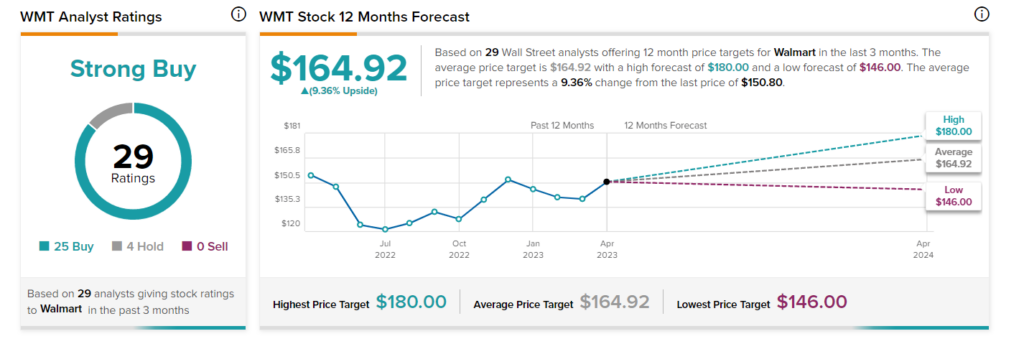

Wall Street analysts are bullish about WMT stock. It has received 25 Buy and four Hold recommendations for a Strong Buy consensus rating. The analysts’ average price target of $164.92 implies 9.4% upside potential. Shares of the company have rallied 5.5% year-to-date.

What is the Price Target for COF?

On TipRanks, COF stock has a Hold consensus rating. This is based on six Buys, five Holds, and three Sells assigned in the past three months. The average price target of $113.23 implies 19.3% upside potential. The stock has gained 2.6% so far in 2023.