Walmart (WMT) is taking its AI drive literally with plans to launch a pilot ‘Smart’ auto care center.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to an article in Axios, the U.S. retail giant wants to reimagine car care with its first “Auto Care Center of the Future” in Arkansas. The pilot center will feature smart-locker key drops and real-time app updates.

Value Services

Indeed, it wants to make car maintenance as easy as stocking the fridge and at consistent value prices with tire services stating at $5, and oil changes at $27.

Axios stated that the first modernized center opens today in Fayetteville, Ark., with nine more pilots coming this year in Texas, Georgia, West Virginia, Ohio and Pennsylvania. It will then evaluate the results, including customer feedback, before deciding whether to continue the roll-out to its nearly 2,600 centers in the U.S.

Customers can schedule tire installations on the Walmart app, check in digitally, drop off keys in a smart locker and track progress in real time while they shop in store.

The pilot starts with tire installations but will expand to oil changes, battery replacements and other maintenance services.

AI Accelerates

Tracy Poulliot, Walmart senior vice president, shopping experience, told Axios that integrating the new auto centers into the app is “combining the ease of digital, the reliability of our in-store service, and the everyday low prices our customers expect.”

It continues the company’s AI acceleration over the last 12 months. Beginning next year, U.S. store and office-based Walmart staff will have access to “cutting-edge AI training” through a new collaboration with tech group OpenAI. That means getting hands-on experience with AI tools.

Its other AI developments include the launch earlier this year of a new GenAI-powered shipping assistant called Sparky. It helps answer product questions from customers and compares options.

It also has internal AI tools such as Wally, which analyzes performance across products, channels and markets for buying merchants to more effectively diagnose stock performance.

Indeed, technology is seen by Walmart as key in challenging rivals such as Target (TGT) and especially e-commerce giant Amazon (AMZN).

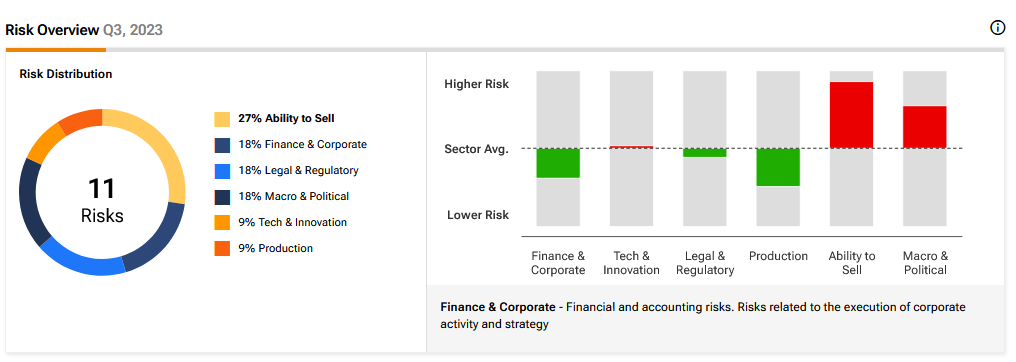

It is why technology and innovation are seen as a key, above sector average, risk for the business – see above.

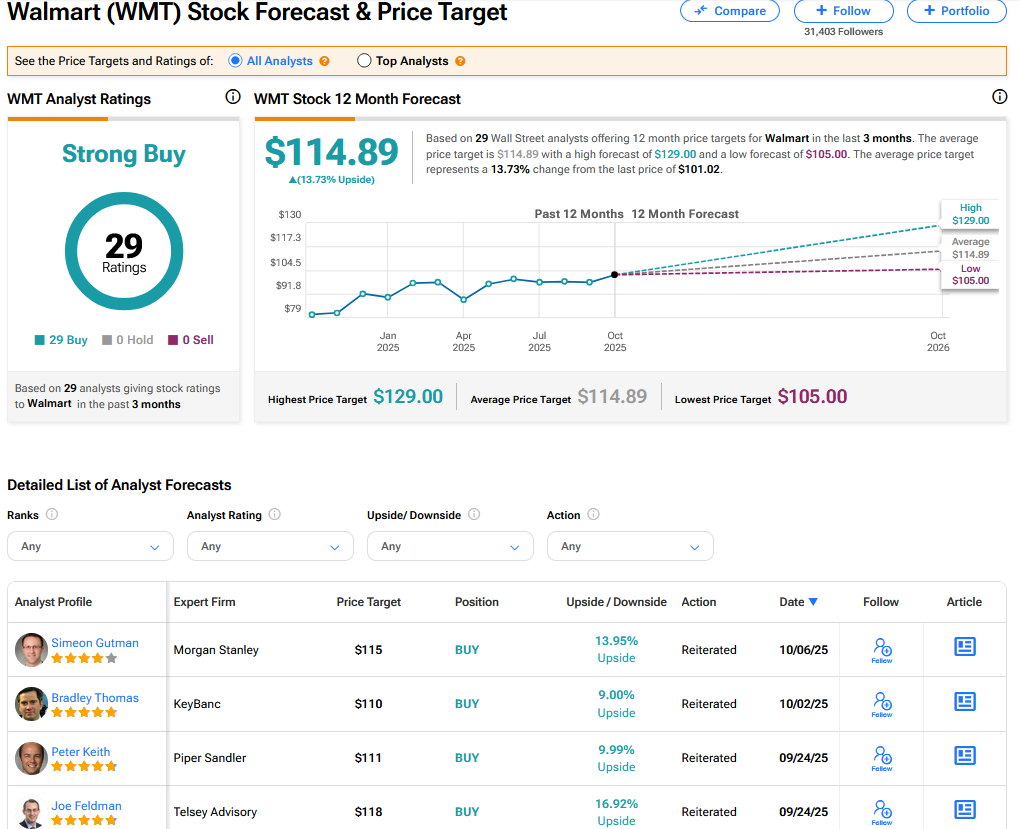

Is WMT a Good Stock to Buy Now?

On TipRanks, WMT has a Strong Buy consensus based on 29 Buy ratings. Its highest price target is $129. WMT stock’s consensus price target is $114.89, implying a 13.72% upside.