Shares in U.S. retail chain Walmart (WMT) were shabbier today despite a leading analyst declaring it could be a leading fashionista.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Michael Lasser, analyst at UBS, said Walmart, best known for its value groceries, is shifting away from selling generic clothing in its stores towards more private brands with a “clear identity.”

Higher Quality

He said Walmart was putting more of a push behind its Scoop and Free Assembly lines, which are part of the company’s moves to selling higher quality clothes.

The analyst also said Walmart is looking to bring in more national brands, such as Reebok, Jessica Simpson and Polo, and added they’re seeing signs that it is gaining traction among younger shoppers.

“We think it’s only scratching the surface, considering how much more of a priority this category now represents versus a few years ago,” Lasser said.

It is also harnessing technology. Its fully-owned tech solution called Trend-to-Product uses both AI and generative AI to scrub the internet for fashion trends and come up with new styles.

According to the company, the new tech is helping it shorten the entire production process from the industry norm of about six months to just six to eight weeks.

The AI tech uses both internal data and external data such as social media posts and videos from runway shows and celebrities at red carpet events. The process helps cut the time designers have to spend researching and coming up with a new style or trend.

Gaining Traction

Lasser made the remarks after a visit on Friday to a Walmart fashion pop-up event in New York, where the chain was promoting the Scoop and Free Assembly lines. More than 70% of the visitors to that event were millennials or Gen Z. Overall, shoppers in those age ranges normally make up under half of Walmart’s customers.

Scoop is a women’s fashion brand that sells clothing and handbags. Free Assembly is geared toward men, women and children. Most products from these two lines are selling for between $15 and $35.

“After a period of reinvention four years ago, these brands now offer trend-oriented, fashion-forward items,” Lasser said. “It appears to be seeing great traction with these two brands.”

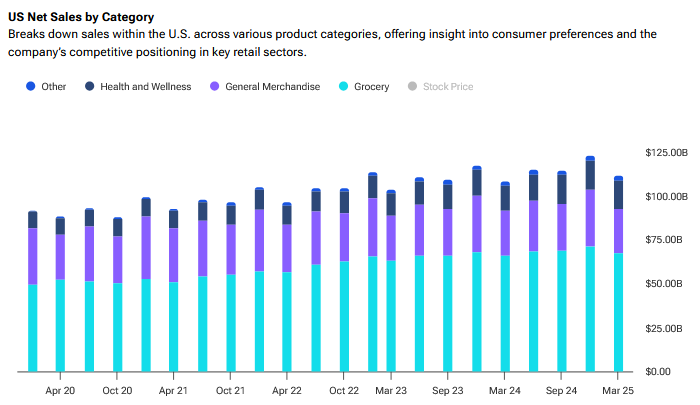

Lasser believes Walmart made around $31 billion in fashion sales last year – under general merchandise above – compared with rival Target (TGT), who netted $16.5 billion. That number could be looking more dapper in the months ahead.

Is WMT a Good Stock to Buy Now?

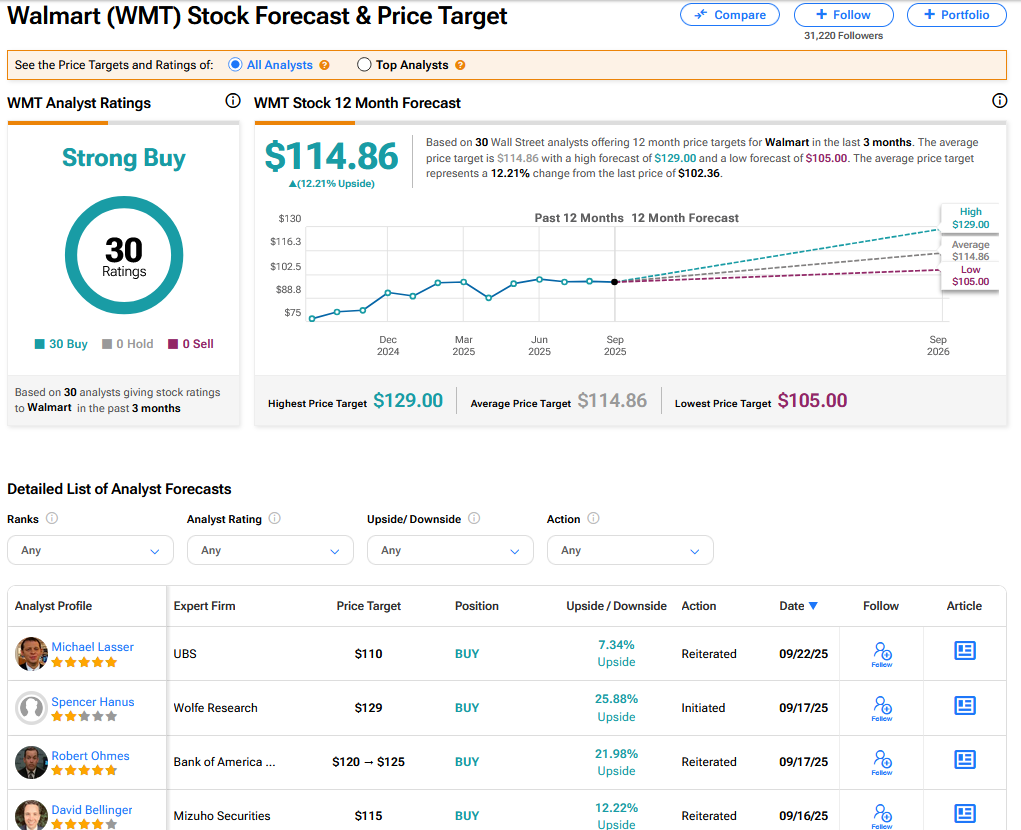

On TipRanks, WMT has a Strong Buy consensus based on 30 Buy ratings. Its highest price target is $129. WMT stock’s consensus price target is $114.86, implying a 12.21% upside.

See more WMT analyst ratings