As a super-sized retail firm with an extensive brick-and-mortar presence, Walmart (NYSE:WMT) does not stand out as a tech-savvy play, let alone one with skin in the artificial intelligence (AI) game. Like it or not, Walmart’s high-tech investments have positioned the firm to become one of the larger, albeit still underrated, AI beneficiaries.

From the supply chain to its mobile shopping app, Walmart has been an active user of AI technologies. In fact, Walmart may be in a position to put its SaaS (software-as-a-service) hat on following recent reports that the firm is looking to sell delivery software powered in part by AI.

Underestimate Walmart as one of the retail juggernauts of the pre-AI age, if you will. But the firm has shown that it’s more than ready to keep up (if not even pull ahead) of rival retailers in this fourth industrial revolution. Given the sheer size and scale of Walmart’s business, I find that AI advancements stand to benefit Walmart, perhaps more than some technology companies that stand to be disrupted by the rapid advancement of both generative and predictive AI technologies.

Despite Walmart’s now expanded multiple, I view WMT stock as having room to run as it continues to make a case that it’s an AI company that just so happens to be one of the largest retailers on Earth. All things considered, I’m staying bullish on WMT stock.

Why AI Could be a Bigger Deal for Walmart Than You’d Think

Walmart may have found itself on the ropes when Amazon (NASDAQ:AMZN) went after the world of e-commerce. Now that Amazon’s AI and its cloud data center business (AWS) have been booming, AI and cloud services may be the main attraction to Amazon shares, not the impressive e-commerce business.

As AI melds into almost every industry, including digital commerce, Walmart stands out as a firm that could really use its size to its advantage. Indeed, economies of scale mean a heck of a lot more in the age of AI and the data cloud.

Walmart may not be in the running to out-innovate Amazon on AI. That said, Walmart still stands to be a massive winner as it keeps its foot on the AI gas. In the AI age, there are bound to be disruptors and the disrupted. As such, the net winners aren’t so clear in these early stages.

Even a tech titan like Adobe (NASDAQ:ADBE) stands to be a potential net loser as AI tears down the barriers to entry in the creative content generation market. Though Adobe can certainly rise to the challenge (it most definitely has with its own slate of AI tech), the AI-driven future is just so uncertain that jittery investors have the right to view it as a potential double-edged sword when it comes to various firms that have dominated their corner of the market for years.

On the one hand, Adobe Firefly and its AI-packed Photoshop are sure to attract a new generation of artists who can use natural prompts like a stroke of a digital paintbrush. On the other hand, startups armed with AI also stand to draw crowds.

In any case, Walmart is one of the companies where AI is a sure positive, even if rival retailers equip themselves with comparable AI technologies. Heck, Walmart seems confident enough in its AI prowess that it’s open to selling its services.

Looking ahead, I’d expect Walmart to leverage AI to improve the experience and value proposition for its customers. Huge money-savers like AI-powered floor scrubbers with inventory management capabilities could lead to a long-lived margin boost. Whether WMT shareholders or its customers pocket the savings, Walmart’s AI monetization abilities are loud and clear.

Vizio Acquisition Bolsters the Walmart AI Thesis

On the surface, Walmart’s acquisition of Vizio (NYSE:VZIO), a smart television maker, seems like a mere move to bring a low-cost Walmart electronics section staple in-house. That said, the Walmart-Vizio deal has created quite the buzz lately, given Walmart’s potential to make a massive splash in the digital advertising scene. Additionally, Walmart may be able to use Vizio as an onramp to get into the business of video streaming, adding yet another perk to its Walmart+ subscription.

Either way, Walmart seems poised to follow Amazon’s lead. This could entail a push into ads, video streaming, and perhaps ad-based video streaming. Count Vizio as a powerful tool in Walmart’s arsenal that it could use to play catch-up with the market’s tech titans.

As you may know, data is a powerful currency in the age of AI. Vizio’s trove of data could serve as an incredibly useful input for Walmart’s AI models.

Is WMT Stock a Buy, According to Analysts?

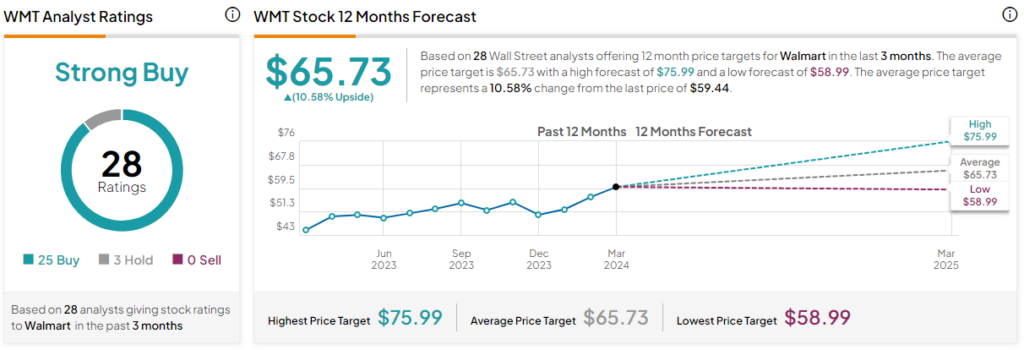

On TipRanks, WMT stock comes in as a Strong Buy. Out of 28 analyst ratings, there are 25 Buys and three Hold recommendations. The average WMT stock price target is $65.73, implying upside potential of 10.6%. Analyst price targets range from a low of $58.99 per share to a high of $75.99 per share.

The Bottom Line

It’s becoming more evident that Walmart is becoming more of an AI-driven tech company than a firm content with sitting on its retail dominance. Though I’m sure Walmart could have done okay even if it didn’t invest so heavily in AI technologies, given the defensive nature of its retail business, it’s the firm’s willingness to put its tech hat on that could bring forth next-level rewards for its shareholders.