The uncertainty regarding the pace of the economic recovery has added to the volatility in the stock market. Amid volatility, TipRanks brings you the latest analyst action on some of your favorite stocks to help you navigate through the ups and downs. Let’s look into the top bullish and bearish calls of the day and see what the Wall Street experts are recommending.

Upgrades

1. Braemar Hotels & Resorts Inc

B. Riley analyst Bryan Maher upgraded Braemar Hotels & Resorts (BHR) to Buy from Hold and increased the price target to $8 from $6.50. In a note to investors, Maher said that he expects shares to appreciate about 34% in the near term, given the positioning of the company’s portfolio relative to industry trends. Furthermore, the analyst believes Braemar will benefit this year with consumers’ inclination towards upper-upscale and luxury drive-to vacation destinations, which includes most of the company’s portfolio.

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 2 Buys versus 1 Hold. The average analyst price target of $9.33 implies 68.4% upside potential to current levels.

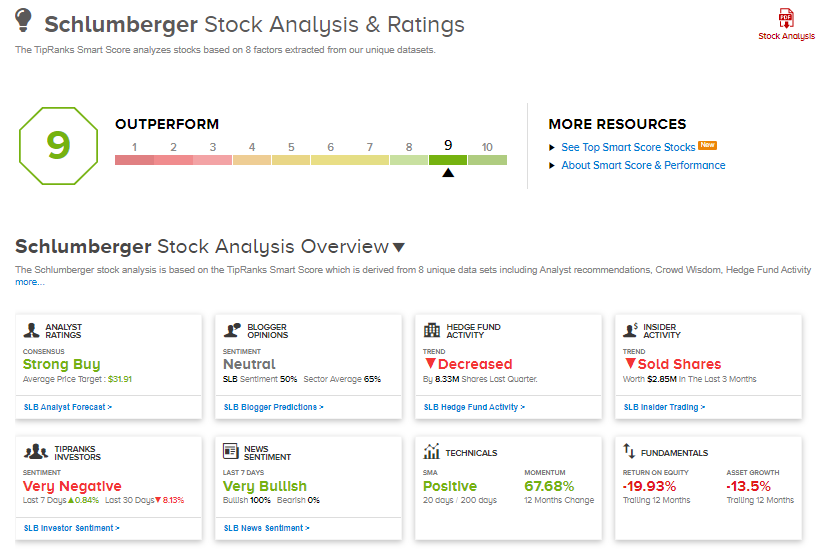

2. Schlumberger Limited

Stephens analyst Tommy Moll upgraded Schlumberger (SLB) to Buy from Hold and increased the price target to $35 from $27. In a note to investors, Moll said that the company is well-positioned to gain from the “coming demand-led upcycle,” which is likely to be supported by international growth. According to the analyst, Schlumberger’s earnings strength has been “reset” with its portfolio rationalization and focused “sustainable” global growth. Therefore, the company now has the option of deleveraging the balance sheet, with the target of returning more cash to shareholders through dividend increases and share buybacks.

Schlumberger scores a 9 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

3. Bank of Princeton

Piper Sandler analyst Nicholas Cucharale upgraded Bank of Princeton (BPRN) to Buy from Hold and increased the price target to $31 from $30 after the release of the company’s first-quarter results. Following the company’s underperformance this year, Cucharale foresees a “significantly improved” outlook and “discounted” valuation.

TipRanks data shows that financial blogger opinions are 100% Bullish on Bank of Princeton, compared to a sector average of 70%.

4. Baker Hughes Company

Citigroup analyst Scott Gruber upgraded Baker Hughes (BKR) to Buy from Hold and increased the price target to $27 from $21. Following the recent underperformance of the shares, according to Gruber, Baker Hughes seems attractively valued at current levels. Furthermore, the analyst believes the current valuation “appears too low” for a company with “one of the best long-term outlooks” in oilfield services, citing positivity across all the company’s segments.

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Baker Hughes, with 5.3% of investors increasing their exposure to BKR stock over the past seven days.

5. Casper Sleep

Wedbush analyst Seth Basham upgraded Casper Sleep (CSPR) to Buy from Hold and increased the price target to $10.50 from $10. Based on the company’s attractive relative valuation and expectations of balanced revenue growth and profitability, the analyst foresees opportunity for the stock.

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Casper Sleep, with 59.2% of investors increasing their exposure to CSPR stock over the past seven days.

Downgrades

1. Proofpoint Inc

Northland Securities analyst Nehal Chokshi downgraded Proofpoint (PFPT) to Hold from Buy but increased the price target to $176 from $150 after Thoma Bravo announced that it will acquire Proofpoint in a cash-deal worth $12.3 billion.

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 6 Buys and 8 Holds. The average analyst price target of $169.09 implies 2.1% downside potential to current levels.

2. W. R. Grace & Co.

Vertical Research analyst Kevin McCarthy downgraded W. R. Grace (GRA) to Hold from Buy and maintained a price target of $70 after the announcement of the agreement under which Standard Industries will acquire W. R. Grace in an all-cash deal valued at $7 billion, or $70 per share in cash.

TipRanks’ Stock Investors tool shows that investors currently have a Very Negative stance on W. R. Grace, with 29% of investors decreasing their exposure to GRA stock over the past 30 days.

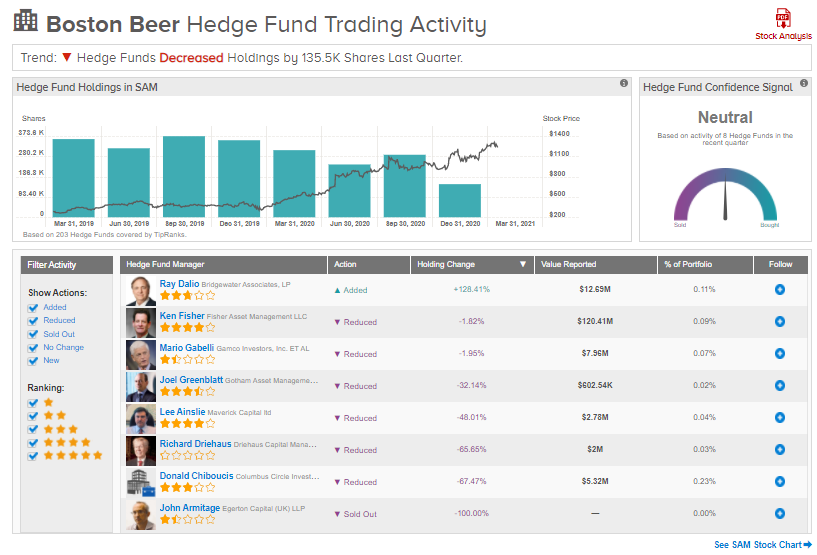

3. Boston Beer

Citigroup analyst Wendy Nicholson downgraded Boston Beer (SAM) to Hold from Buy and maintained a price target of $1,395. Following a 29% appreciation in the company’s shares so far this year, and 240% since the beginning of 2020, Nicholson said, “At this point, it feels to us as if the stock is priced for perfection.”

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Boston Beer is currently Neutral, as 8 hedge funds decreased their cumulative holdings of the stock by 135,500 shares in the last quarter.

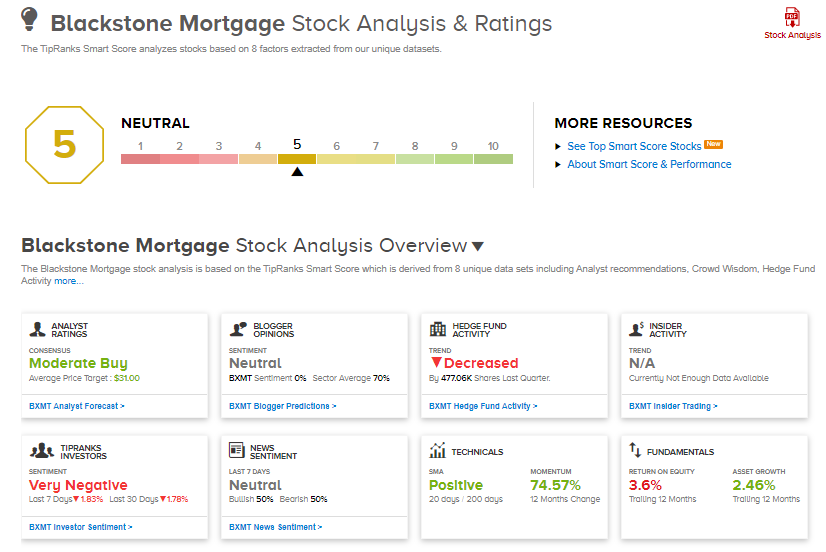

4. Blackstone Mortgage

J.P. Morgan analyst Charles Arestia downgraded Blackstone Mortgage (BXMT) to Hold from Buy but increased the price target to $31 from $29. According to Arestia, the stock lacks a near-term catalyst to “re-rate higher beyond pre-COVID valuations.” Furthermore, the analyst believes that peer stocks “trading at cheaper valuations” could be considered for investors interested in gaining exposure to similar return on equity profiles. Moreover, he foresees “limited opportunity for significant multiple expansion” in Blackstone Mortgage’s core lending business, without any further catalystsbeyond additional loan growth.

According to TipRanks’ Smart Score system, Blackstone Mortgage gets a 5 out of 10, which indicates that the stock is likely to perform in line with market averages.

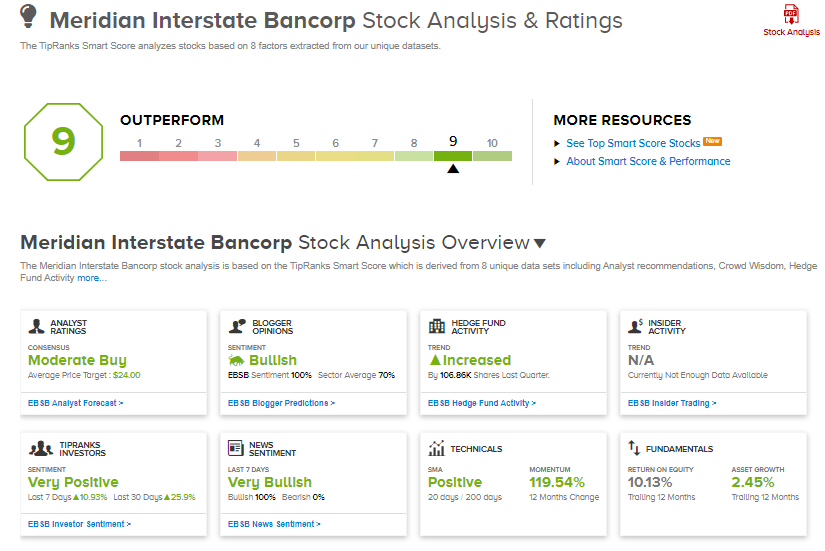

5. Meridian Bancorp

Raymond James analyst William Wallace downgraded Meridian Bancorp (EBSB) to Hold from Buy “following the company’s announcement that it reached a definitive agreement to merge into Independent Bank Corp. (INDB).”

Despite the downgrade, Meridian Bancorp scores a 9 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Besides the above, you can also have a look at the following:

3 “Strong Buy” Momentum Stocks With More Room to Run

All Eyes on Tesla Stock Ahead of Earnings Today

Raymond James: These 3 Stocks Have Over 100% Upside on the Horizon

Dividend-Yield Calculator