Retailer and wholesaler of health and wellness products Walgreens Boots Alliance (NASDAQ:WBA) has announced plans to close 450 stores in the U.S. and U.K. over the upcoming year. The company wants optimize current locations and focus investments on areas of potential growth. However, many factors surrounding WBA raise investor and analyst concerns.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Walgreens Boots to Optimize Locations

Retail pharmacy chain operator Walgreens Boots Alliance said that Boots will close 300 stores in the U.K., most of which are geographically close to each other, and another 150 Walgreens branches in the U.S., over the upcoming year.

EVP and Global Finance Chief, James Kehoe announced the closures in the WBA Q3 earnings call and said, “As you have seen, we are accelerating our portfolio optimization to further simplify the business.”

Interestingly, the reduction in the number of stores comes amid the company reporting a 25% increase in website sales for the three months ending May. This represents more than 14% of its total sales.

Yesterday, WBA reported its Q3 earnings with a 8.6% year-over-year growth in revenue while net earnings narrowed by 59% to $118 million. Amid challenging consumer and macroeconomic conditions, WBA lowered its FY23 adjusted earnings to come in at $4.00 to $4.05 per share vs. the prior outlook of $4.45 to $4.65 per share.

Why Is WBA Stock Falling?

In the past 3 months, WBA stock price has lost 14% to touch down close to its 52-week low levels in the last week of May. The stock has not been able to significantly recover since then.

The company has been divesting stakes to generate liquidity for investments. This raises concerns about whether the offloads are for liquidity or indicate deeper problems. In June, WBA disclosed that it has further reduced its Option Care Health stake to 6% from the prior 14% through offloading shares for almost $330 million. In May, it sold AmerisourceBergen shares for around $644 million.

Additionally, in early June, the CFO of Boots stepped down after serving for five years. This comes one year after its U.S. parent abandoned plans to sell the Boots business.

In April, an Activist Insight report explained that attractive dividends (6.1% dividend yield) are the only selling point that the WBA stock offers. Other factors, like scattered earnings growth, falling stock prices, and rising debt levels (short term debt almost tripled from prior year levels) all add to investors’ concerns.

Is Walgreens a Buy, Sell, or Hold?

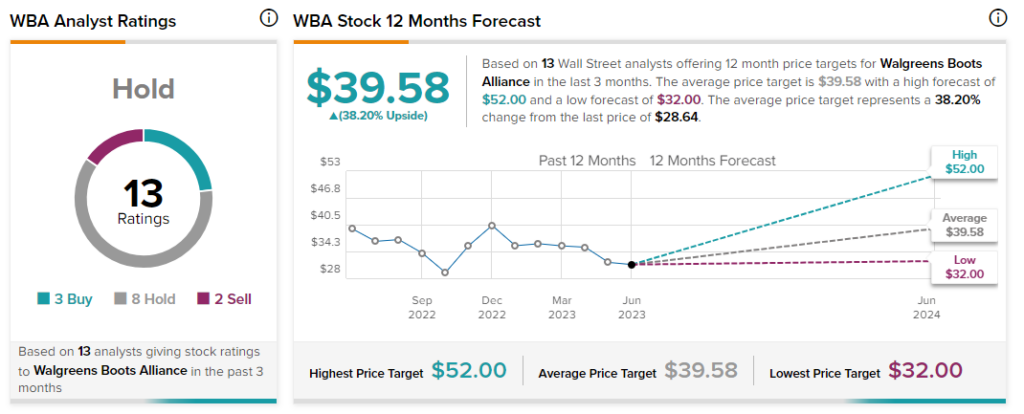

Of the 13 Wall Street Analysts covering WBA stock, three rate it a Buy while eight assign a Hold and two maintain a Sell rating, taking the average analyst consensus rating to Hold. Further, analysts’ 12-month average price target of $39.58 implies a 38.2% upside potential from current levels.

Yesterday, after WBA reported Q3 earnings, the stock saw two Hold reaffirmations at Evercore ISI and UBS, with 11.7% and 22.2% upside potentials respectively from current levels. Citing a tough quarter for the company and a soft outlook for FY23, the rating firms remained sidelined on the stock.