The good times keep on a-rolling for Nvidia (NASDAQ:NVDA). 2024 has continued in much the same vein as 2023, with the stock a major gainer, delivering year-to-date returns of 46%.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Those gains are built on the continued opportunity in AI, with Deutsche Bank’s Ross Seymore, a stock expert ranked amongst the top 1% of Wall Street analysts, noting there’s an underlying fundamental aspect driving the bullish narrative.

“This enthusiasm can be somewhat supported by tangible datapoints (e.g. META’s guidance for capex to continue to grow post-2024; strong demand from sovereign entities persisting),” the 5-star analyst said.

With the chip giant about to report F4Q24 results (January quarter) next Tuesday (February 21st), Seymore thinks another strong showing is about to drop.

“As we noted after its last earnings call, we acknowledge the fundamental momentum remains in NVDA’s favor in the near- to medium-term, and for this reason we would not be surprised if NVDA delivered yet another multi-billion dollar beat & raise,” Seymore opined.

For the quarter, Seymore expects Nvidia will generate revenues of $20.5 billion, amounting to a 13% sequential increase and just a touch above the guide’s midpoint at $20 billion and the Street’s forecast of $20.2 billion. At the bottom-line, Seymore is calling for PF EPS of $4.60, also above consensus at $4.55.

As for the guide, the analyst expects momentum will “remain in NVDA’s favor.” Seymore is calling for F1Q25 revenues of $22.1 billion, representing an 8% quarter-over-quarter increase and a 207% year-over-year uptick, also above the Street’s forecast of $21.5 billion. The outlook based on “increased supply and still-strong demand (with risk to this estimate once again skewing to the upside given NVDA’s recent track record of beats).” Seymore’s EPS estimate stands at $5.03, also higher than the Street’s $4.83 forecast.

So, essentially Seymore’s expectations are all above consensus. But here’s the twist; the analyst believes it is taken as a given Nvidia is about to deliver another beat-and-raise extravaganza and the shares already reflect that scenario. The real question revolves around the longer-term outlook.

“The more critical metric should be commentary on long-term sustainability of demand, rather than near-term momentum,” Seymore explained. “As such, we maintain our Hold (i.e., Neutral) rating, and look forward to revisiting our valuation methodology during earnings when we get a clearer picture on normalized earnings power + market-wide valuations.”

That Hold rating is accompanied by a $560 price target, suggesting the shares are now overvalued by 24%. (To watch Seymore’s track record, click here)

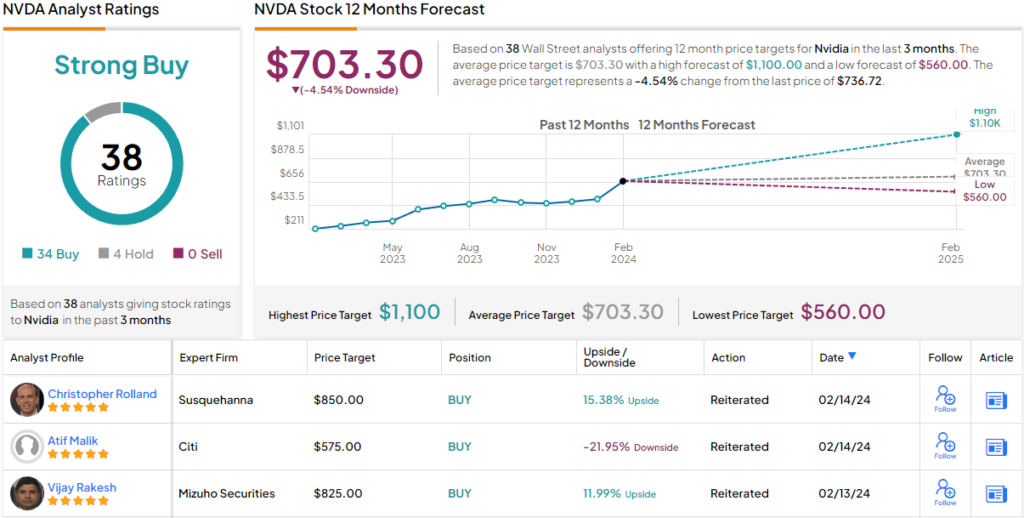

Seymore, however, is amongst a minority on Wall Street. 3 others join him on the sidelines, but with an additional 34 Buys, the analyst consensus rates the stock a Strong Buy. That said, many appear to think the stock has surged enough for now; as such, the $703.30 average target implies the shares will stay rangebound for the foreseeable future. (See Nvidia stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue