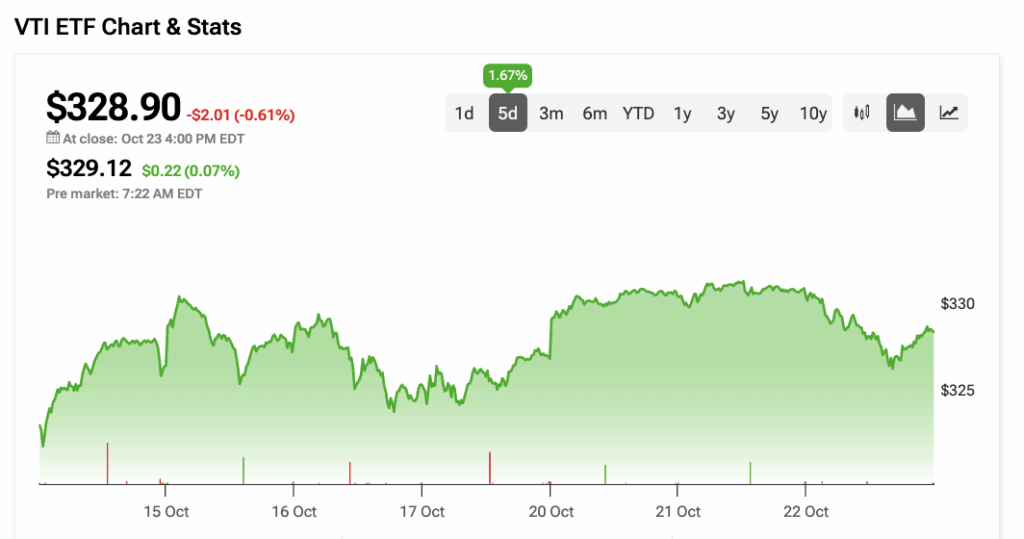

How is VTI stock faring? Vanguard Total Stock Market ETF (VTI) is an all-in-one fund that lets investors invest in the entire U.S. stock market. VTI ETF is up 1.67% over the past five days and up 15.25% year-to-date.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

VTI ETF’s Performance

The VTI ETF declined by 0.61% on Wednesday. Likewise, the Nasdaq Composite was also down by 0.93%, and the S&P 500 declined 0.53%. U.S. stocks traded mixed amid weak earnings reports from Texas Instruments (TXN) and Netflix (NFLX).

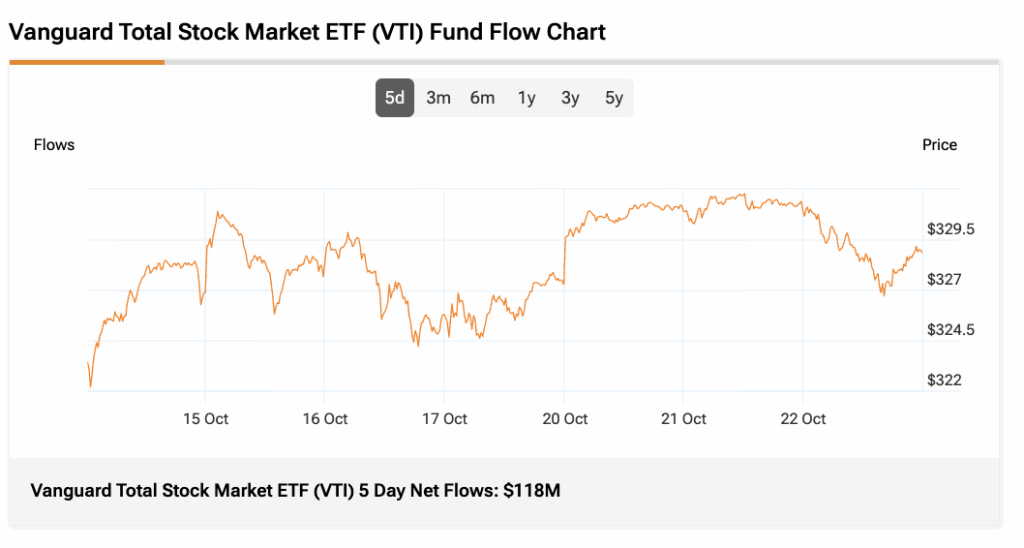

VTI’s three-month average trading volume is 4.02 million shares. Meanwhile, its 5-day net flows totaled $118 million, showing that investors added capital to VTI over the past five trading days.

VTI’s Price Forecasts and Holdings

According to TipRanks’ unique ETF analyst consensus, determined based on a weighted average of analyst ratings on its holdings, VTI is a Moderate Buy. The Street’s average price target of $376.60 implies an upside of 14.50%.

VTI’s top three holdings are chipmaker Nvidia (NVDA) at 6.69%, followed by tech giants Microsoft (MSFT) at 5.98% and Apple (AAPL) at 5.87% of the fund’s total weight.

Currently, VTI’s five holdings with the highest upside potential are FibroBiologics (FBLG), Biodesix (BDSX), BioAtla (BCAB), Cibus (CBUS), and Clearside Biomedical (CLSD).

Meanwhile, its holdings with the greatest downside potential are LiveOne (LVO), Opendoor Technologies (OPEN), GoPro Inc. (GPRO), and QVC Group (QVCGA).

Notably, VTI ETF’s Smart Score is eight, implying that this ETF is likely to outperform in line with the broader market.

Power up your ETF investing with TipRanks. Discover the Top Equity ETFs with High Upside Potential, carefully curated based on TipRanks’ analysis.