How is VOO stock faring? The Vanguard S&P 500 ETF (VOO), which tracks the S&P 500 (SPX), is down 0.39% in pre-market trading today. Also, it fell 1.06% on Thursday, primarily due to a weak U.S. jobs report and sharp losses in big tech names like AMD (AMD), Nvidia (NVDA), and Microsoft (MSFT).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

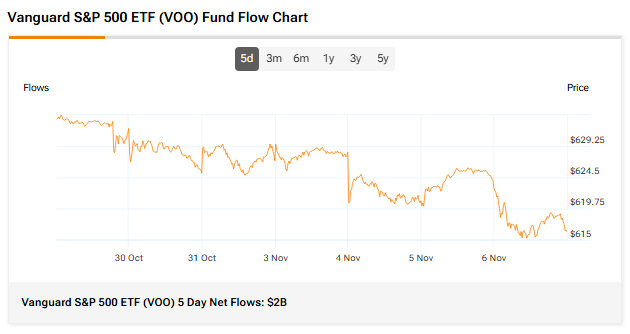

Meanwhile, the VOO ETF is down 2.70% in the past five days but up 15.45% year-to-date.

Fund Flows and Sentiment

According to TipRanks data, VOO recorded 5-day net flows of about $2 billion, showing steady investor demand for large-cap U.S. exposure.

VOO’s Price Forecasts and Holdings

According to TipRanks’ unique ETF analyst consensus, determined based on a weighted average of analyst ratings on its holdings, VOO is a Moderate Buy. The Street’s average price target of $720.32 implies an upside of 16.89%.

Currently, VOO’s five holdings with the highest upside potential are Loews (L), Fiserv, Inc. (FI), DuPont de Nemours (DD), CarMax (KMX), and Moderna (MRNA).

Meanwhile, its five holdings with the greatest downside potential are Micron (MU), Paramount Skydance (PSKY), Incyte (INCY), Applied Materials (AMAT), and Tesla (TSLA).

VOO ETF’s Smart Score is eight, implying that this ETF will likely outperform the market.

Does VOO Pay Dividends?

Yes, VOO pays dividends, offering investors a source of regular income. The ETF distributes these payments every quarter to shareholders. They come from the dividends paid by the companies in the S&P 500. Since company payouts change over time, the dividend amount from VOO also varies each quarter.

VOO’s yield as of today is 1.13%.

Power up your ETF investing with TipRanks. Discover the Top Equity ETFs with High Upside Potential, carefully curated based on TipRanks’ analysis.