The cloud computing and virtualization technology company VMware (VMW) beat earnings and revenue estimates in the fiscal first quarter. Shares of the company declined 2.1% to close at $157.89 on May 28.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company reported total revenue of $2.99 billion in Q1, which surpassed the Street’s estimates of $2.98 billion and increased 9% from the year-ago period.

License revenues declined 2.1% year-over-year to $646 million, while Subscription & SaaS revenues increased 29% to $741 million. Additionally, services revenue increased 7% to $1.6 billion.

Adjusted earnings soared 16% year-over-year to $1.76 per share, beating the consensus estimate of $1.73 per share.

VMware CFO and Interim CEO, Zane Rowe said, “We are pleased with our Q1 financial performance as we delivered solutions for customers in strategic areas like multi-cloud, application modernization and digital workspaces, while focusing on providing a broader set of consumption choices with our Subscription and SaaS offerings.”

Rowe added, “We are excited to welcome Raghu Raghuram as the next CEO of VMware. This milestone, along with the proposed Dell spin-off, sets the stage for the company’s next innovative chapter.” (See VMware stock analysis on TipRanks)

Following the fiscal Q1 earnings release, Monness analyst Brian White reiterated a Hold rating.

White said, “Given last year’s disappointing stock price performance, VMware’s valuation has become more reasonable compared to the recent past and the company holds the potential to benefit from an improving global economy.”

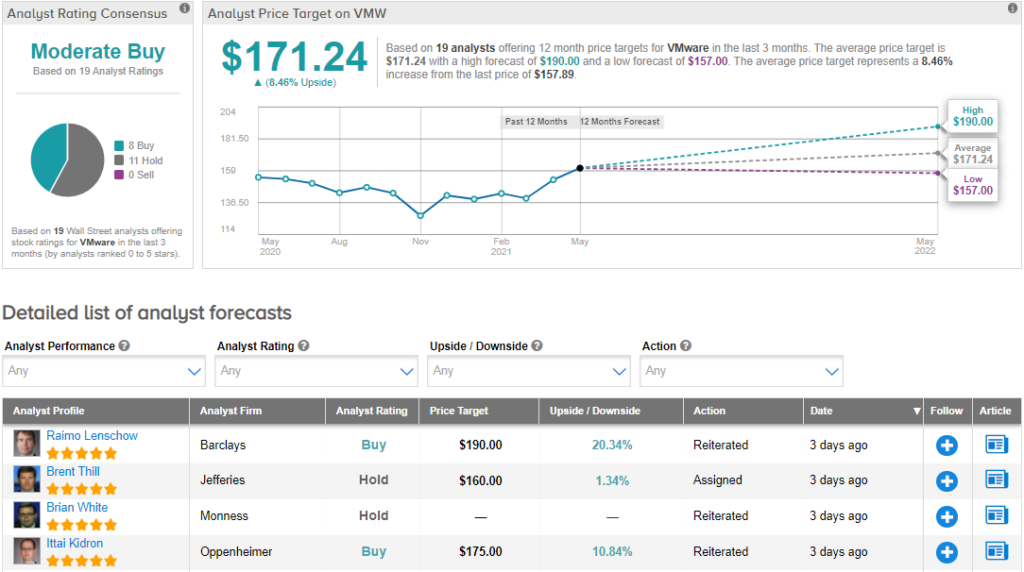

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 8 Buys versus 11 Holds. The average analyst price target of $171.24 implies 8.5% upside potential to current levels. Shares have increased 12.9% over the past six months.

Related News:

Dollar Tree Delivers Strong Q1 Results, Shares Down 8%

Mercury Systems Snaps up Pentek for $65M

Nutanix Posts Smaller-Than-Feared Quarterly Loss, Revenue Beats Estimates