Shares of sporting and outdoor products provider Vista Outdoor (NYSE:VSTO) are under pressure today. This comes after the company agreed to sell its Sporting Products business to Czechoslovak Group (CSG) at an enterprise value of $1.91 billion. The all-cash deal is part of VSTO’s plan to split the company into separate entities.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

The deal values the Sporting Products business at 5x its Fiscal 2024 EBITDA and is anticipated to close in the 2024 calendar year. Further, upon completion of the transaction, VSTO’s Outdoor Products business will be called Revelyst and trade on the NYSE under the ticker GEAR.

Separately, VSTO also provided a preview of its second-quarter results. Sales for VSTO’s Sporting Products segment are estimated to be between $347 million and $352 million, alongside an operating income in the range of $91 million to $95 million.

In addition, sales of the company’s Outdoor Products segment are anticipated to be between $325 million and $330 million, with operating income in the range of $11 million to $15 million. For Fiscal year 2024, the company sees sales in the range of $2.725 billion to $2.825 billion, whereas EPS is seen landing between $3.65 and $4.05.

What is the Target Price for VSTO?

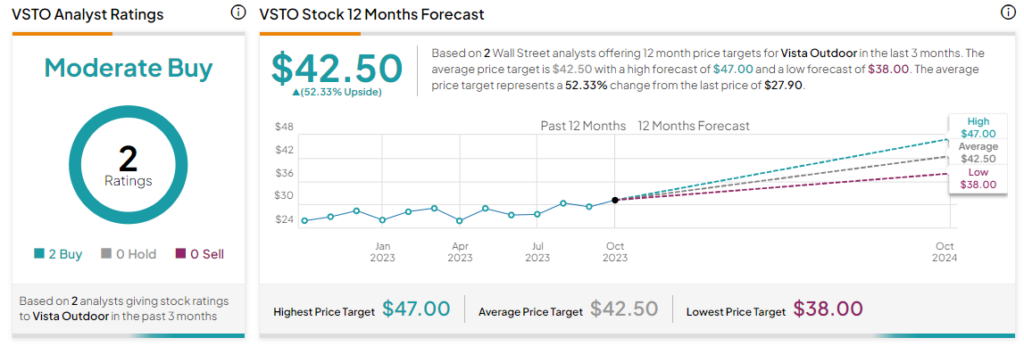

Overall, the Street has a Moderate Buy consensus rating on Vista Outdoor. The average VSTO price target of $42.50 implies a substantial 52.3% potential upside. That’s after a nearly 16% drop in the share price in the morning session today.

Read full Disclosure