Outdoor recreation and shooting sports products maker Vista Outdoor (NYSE:VSTO) has received an unsolicited merger proposal from Colt CZ Group, a maker of pistols and rifles. The cash and stock merger offer values Vista’s shares at $30 apiece. The proposal attempts to block Vista’s recently announced agreement to sell its Sporting Products business to Czechoslovak Group for $1.91 billion. VSTA shares were up over 2% in Wednesday’s extended trading session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Vista Receives Colt’s Surprise Merger Offer

Colt’s offer for Vista values the company at $30 per share and includes a $900 buyback program that would be executed following the closing of the deal. In a letter addressed to Vista’s board, Colt’s CEO Jan Drahota said that through this transaction, Colt is trying to regain Vista’s lost shareholder value since the company announced its decision to spin off the Outdoor Products segment 18 months back.

He also pointed out investors’ unfavorable reaction to the October 16 announcement of the sale of the Sporting Products segment to Czechoslovak Group and revised earnings guidance for 2024, with the stock falling about 24% the same day.

Drahota contended that if the separation of the Sporting Products segment goes through, the remaining Outdoor Products segment will be “subscale as a standalone public company with substantial risks.” Drahota finds Colt’s proposal to be better as it can bring substantial value to the Sporting Products segment.

Reacting to the offer, Vista said that its board of directors will carefully review Colt’s proposal.

Is Vista Outdoor a Good Stock to Buy?

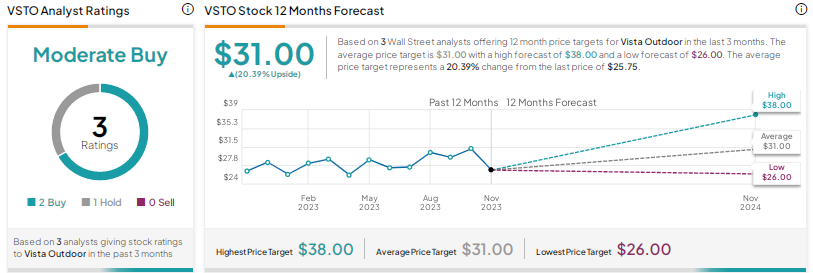

Wall Street is cautiously optimistic about Vista Outdoor stock, with a Moderate Buy consensus rating based on two Buys and one Hold. The average price target of $31 implies 20.4% upside potential. Vista shares have risen 86% year-to-date.