You might not know it to hit a gas station lately, but fuel prices are on the decline. That’s what’s happening at oil stock Vertex Energy (NASDAQ:VTNR), who hit a low it hadn’t seen in almost a year and a half after revealing that fuel prices were lower in the second quarter. Vertex lost over 20% at one point in Tuesday afternoon’s trading, showing just how bad the situation is.

Vertex Energy hasn’t traded this low since February 2022, reports noted, and it’s all thanks to not only an announcement that the prices Vertex got for fuel is in decline, but also the announcement that investors should expect that oil refining margins will drop for the relevant quarter. Previously, Vertex looked for capture rates between 50% and 54%. Now, Vertex expects a capture rate of between 30% and 35%, around half of previous expectations. Moreover, Vertex also looked for higher expenses in that processing, roughly 7.6% higher.

This comes at a time when Vertex is actually processing more than ever. Its Mobile Refinery in Alabama, noted a report from EnergyPortal.eu, was expected to process 76,000 barrels per day. Earlier forecasts looked for a range between 68,000 and 72,000 barrels per day. While supply to the refinery could have been a problem, Vertex got proactive and went hunting for short-term supplies to help smooth out the rough spots accordingly.

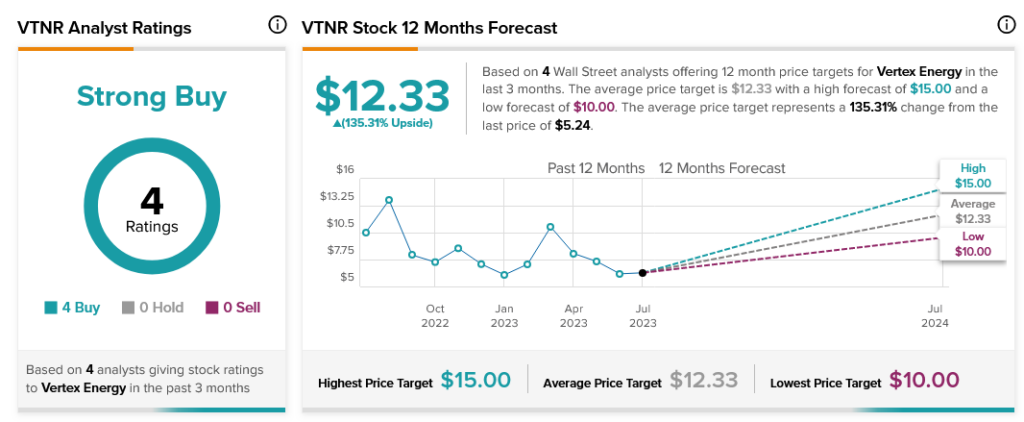

Though Vertex’s quarter may not turn out that great, analysts aren’t fazed. With a unanimous score of four Buy ratings, Vertex Energy stock is considered a Strong Buy. Further, Vertex Energy stock offers investors a hefty 135.31% upside potential thanks to its average price target of $12.33.