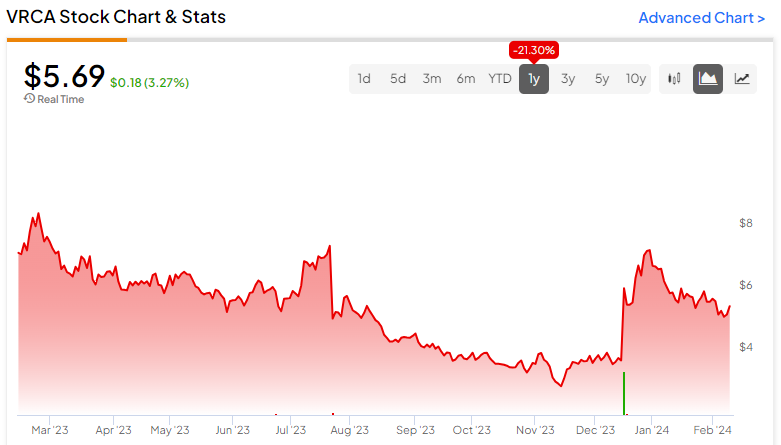

Sometimes, traders may bet against a solid enterprise based on the prevailing winds of the moment. That may be the case with Verrica Pharmaceuticals (NASDAQ:VRCA), a leader in a subsegment of the broader skin disease therapeutics market. Despite its relevance, bearish traders have shorted Verrica shares, creating an imbalanced profile. However, a tip to the bullish side of the spectrum could rapidly panic these traders. Because of its short-squeeze potential, I’m bullish on VRCA stock and its call options.

VRCA Stock Offers Relevance, but the Bears Don’t Care

Young children may be familiar with the Care Bears, the lovable cartoon characters that originated in the 1980s. However, the folks shorting VRCA stock might as well be called the don’t-care bears. Despite the upside potential of Verrica’s treatment of molluscum contagiosum – an infectious skin disease caused by a poxvirus – the pessimists have lashed out against Verrica shares.

It’s an odd setup. Late last year, Verrica – along with its partner Torii Pharmaceutical of Japan – reported positive top-line results from their Phase 3 trial of TO-208, a therapeutic for the aforementioned infectious skin disease. Significantly, TO-208 achieved the primary endpoint of efficacy, which centered on a defined proportion of subjects achieving complete clearance of all treatable molluscum lesions. Additionally, TO-208 was well tolerated in the study.

Despite the seemingly encouraging result, the bears began targeting VRCA stock to accrue “negative” profits. In other words, by shorting or borrowing the security and selling it prior to its market decline, the bears can pick up the stock at a (hopefully) much lower price. Subsequently, they can fulfill the terms of the loan by returning the borrowed shares and pocketing the difference as profit.

That’s boilerplate stuff. On any given day, someone somewhere is usually shorting a publicly traded company. However, most targeted companies don’t carry a short interest of 35.12% of their floats. As well, they don’t incur a short interest ratio of 59.17 days to cover.

Indeed, experts generally agree that short interest of float above 20% is considered high and indicates pessimistic sentiment. Adding to that is the short-interest ratio. At 59.17, that’s the number of trading sessions that the bears will need to cover their short positions based on average trading volume.

If they were forced to unwind their positions today, the calendar could turn to early May before they’re finally out of their obligation.

Pressure in One Market Could Lead to Upside in Another

Another factor to consider regarding short squeezes is the concept of uncapped losses. Unlike buying a put option – which increases in value as the target security falls – the potential loss for a direct short position is undefined. That’s because a security can theoretically rise indefinitely.

As a result, bears who are caught red-handed in a short squeeze have a painful, high-pressure choice to make. They could cut their losses immediately by buying back the borrowed securities at a modestly higher price, or they could wait it out and hope that the stock falls back down. However, if the security continues to rise, their position could get hammered, likely drawing a margin call.

Of course, smart short traders recognize when the jig is up. So, to avoid devastating losses, they’ll exit their positions. However, the very act of exiting a short position involves buying back the borrowed securities. That’s going to put upside pressure on the target shares, which led me to speculate on VRCA stock.

Nevertheless, high-conviction contrarian bulls can enhance their return potential by buying call options. It’s a compelling idea but also carries risks of its own.

On the positive side, the contracts could be had for relatively cheap. For instance, the VRCA May 17 ’24 7.50 Call is currently trading at 85 cents. Therefore, if you want to buy one call option – which carries the leverage of 100 shares of VRCA stock – you only pay $85 (assuming no other fees).

However, the downside is that VRCA stock options feature very low volume and open interest. Therefore, the bid-ask spreads are wide, presenting certain “administrative” challenges. However, if VRCA flies – which it could do because of the robust short interest – there may be someone who would buy your call at an attractive price.

A Good Narrative Play, but It’s a Narrative Play, Nonetheless

Primarily, the core thesis of VRCA stock involves speculation – there’s no getting around that. When you consider the financials, it doesn’t leave you with a particularly reassuring sentiment. For example, revenue for the September 2023 quarter sat at $2.92 million, down sharply from the $8.32 million posted one year ago.

However, the idea here is that the revenue and profitability will come. If not that, then a possible buyout from a large company may materialize. After all, the market capitalization of VRCA stock only comes in at $220.4 million. With a positive Phase 3 trial in tow, it’s arguably worth consideration for speculators.

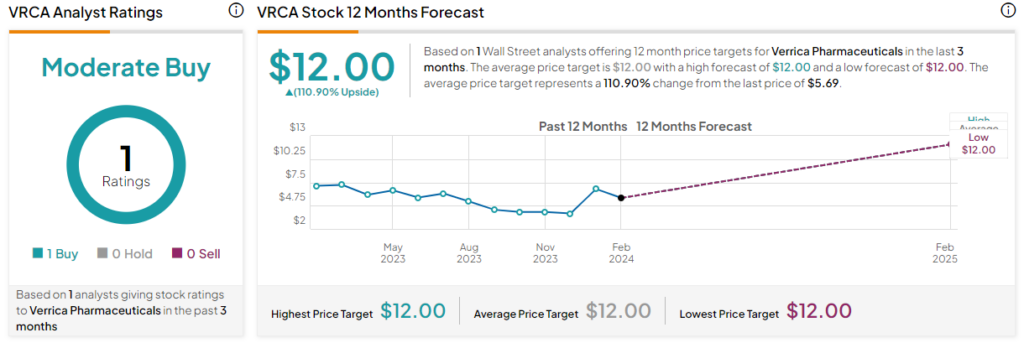

Is Verrica Pharmaceuticals Stock a Buy, According to Analysts?

Turning to Wall Street, VRCA stock has a Moderate Buy rating based on just one Buy assigned in the past three months. VRCA stock’s price target is $12, implying 110.9% upside potential.

The Takeaway: VRCA Stock Bears May Have Become Too Aggressive

Short trades happen all the time. However, it’s rare to see the short interest of float hit over 35% while the short interest ratio soars above 59 days to cover. For pessimists of VRCA stock, there are too many things that could go wrong, leading to tremendous contrarian upside. Further, Verrica is actually a surprisingly relevant enterprise, delivering the scientific goods. Directly shorting the company seems awfully risky, making the contrarian case all the more enticing.