Verizon (VZ) stock slipped on Monday after the wireless company announced Dan Schulman as its next CEO. Schulman was already the company’s Independent Lead Director on its board and is the former CEO of PayPal (PYPL). He will replace Hans Vestberg, who has led Verizon since 2018. However, Vestberg will stick around as a Special Advisor through Oct. 4, 2026, and will remain on the company’s Board of Directors until its 2026 Annual Meeting.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Schulman laid out his plans for Verizon alongside the CEO transition announcement. He said, “Verizon is at a critical juncture. We have a clear opportunity to redefine our trajectory, by growing our market share across all segments of the market, while delivering meaningful growth in our key financial metrics. We are going to maximize our value propositions, reduce our cost to serve, and optimize our capital allocation to delight our customers, and deliver sustainable long-term growth for our shareholders.”

Verizon also provided investors with a small earnings update in its CEO change announcement. The company said it will report its Q3 2025 results on October 29, 2025. Additionally, the company reaffirmed its previously provided financial guidance for the full year of 2025.

Verizon Stock Movement Today

Verizon stock was down 1.9% on Monday, but remained up 14.74% year-to-date. Even so, the company’s stock has notched a slight decrease over the past 12 months. This mixed stock performance reflects Schulman’s comments about the company being at a critical juncture.

Is Verizon Stock a Buy, Sell, or Hold?

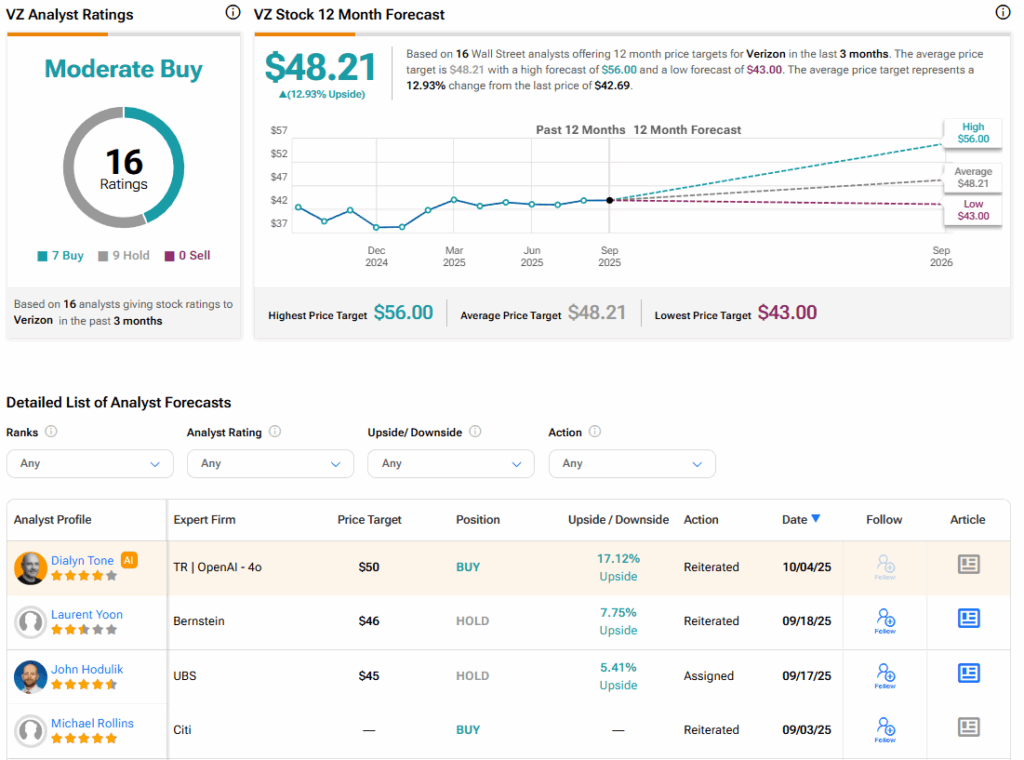

Turning to Wall Street, the analysts’ consensus rating for Verizon is Moderate Buy, based on seven Buy and nine Hold ratings over the past three months. With that comes an average VZ stock price target of $48.21, representing a potential 12.93% upside for the shares.