There are three words right now that are sending cold chills down the backs of a lot of investors out there: commercial real estate. But it’s not proving much of a problem for e-commerce giant Amazon (NASDAQ:AMZN), whose investors are keeping shares up fractionally in Thursday afternoon’s trading after word emerged about plans to dial back its building count.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Amazon is looking to up its vacancy rate to 10% by 2027-29, a move that will cut about $1.3 billion out of its budget. It’s planning to reach that target by cutting back on office space and getting out of leases early. Basically, Amazon is looking to augment its “collaboration and efficiency,” two points that have been part of the relentless return-to-office drumbeat that we’ve been hearing over the course of the last two years or so.

Paring Back Excess

Interestingly, note those same reports, Amazon apparently had some excess office space on its hands too, which will be better served as not being an expense that Amazon isn’t getting any utility out of. While that’s likely to be a problem for those who count on the revenue from that office space, it’s not helping Amazon much. In fact, reports note that Amazon has a 34% office vacancy rate. So, even as it joins the relentless call for return-to-office, it’s likely appreciating that it doesn’t need so much office to begin with.

Is Amazon a Buy, Hold, or Sell?

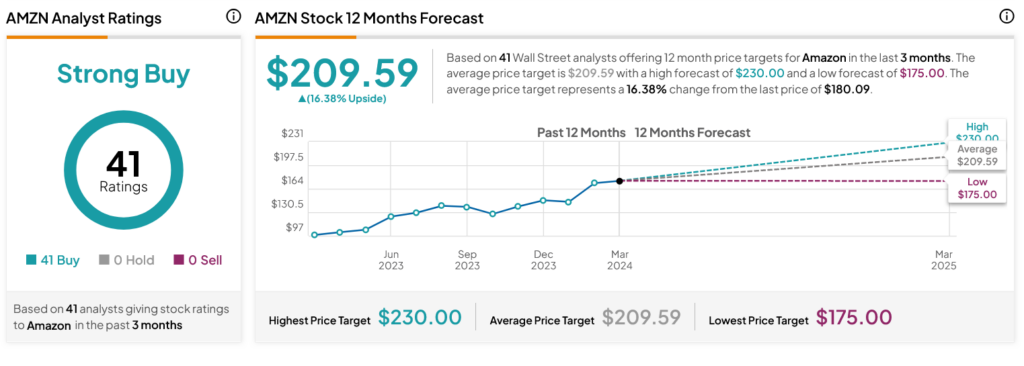

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMZN stock based on 41 Buys assigned in the past three months, as indicated by the graphic below. After a 79.35% rally in its share price over the past year, the average AMZN price target of $209.59 per share implies 16.38% upside potential.

Disclosure

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue