Vehicle service center Valvoline (NYSE:VVV) – which mostly focuses on quick-service oil changes – is a boring enterprise. Given the push for broader EV integration, it’s also fighting a war against inevitable obsolescence. However, the EV sector fallout also means combustion-powered vehicles may have a longer-than-expected shelf life. If so, that could be a surprising net positive for Valvoline. Logically, then, I am bullish on VVV stock.

VVV Stock Gets a Lifeline from a Competing Industry’s Downturn

Prior to the erosion of demand for electric-powered cars and SUVs, Valvoline’s management team must have been doing some uncomfortable math. Should EVs become the future of powered mobility, then the company’s business will suffer a severely negative paradigm shift. After all, one of the benefits of making the transition to electric is that EVs require far fewer moving parts.

Stated differently, oil-change service providers could go the way of the public phone booth. When was the last time you remember seeing one of those things?

However, the sharp erosion of demand in the EV sector may have given Valvoline a critical lifeline. The signs are quite apparent. For starters, legacy automakers have begun scaling back or delaying their transition to electric mobility. That’s a remarkable sentiment shift when earlier, automakers appeared desperate to compete with Tesla (NASDAQ:TSLA).

Speaking of which, much of the pain in the space can be attributed to the sector’s modern-day pioneer (historically, EVs were originally developed in 1884). In a bid to crush upstart rivals and boost its own lagging sales, Tesla began slashing prices for its lineup. That forced a negative feedback loop, causing other companies to reduce their prices.

However, the initial directive begs the question: if EVs were flying out of showroom floors, why lower prices? In all other circumstances, the fairest response to escalating demand is to raise prices. That way, the consumers who absolutely want the target product the most can fork over the premium. This is how capitalism works.

However, slashed prices mean that consumers need an incentivization to buy the product. And when the cuts get increasingly steeper, it generally indicates that people are not on the fence. No, they’re further away from the fence, on the cold side of the spectrum.

This dynamic indicates that the combustion platform’s relevance may be longer than expected. Therefore, Valvoline should expect continued demand, which is very good for VVV stock.

The Middle Ground Approach Also Favors Valvoline

In the current divisive political environment, the concept of the middle ground has become more prominent. Two parties with competing interests engage in a give-and-take until they reach an acceptable compromise. Neither side completely wins out. Still, in the automotive arena, the middle ground emphatically favors Valvoline. That’s another reason why VVV stock deserves a closer look.

When drivers consider making the transition to electric, they understand the benefits: higher efficiencies, lower total cost of ownership, and potential tax breaks, among others. However, they also recognize various concerns, particularly range anxiety and the availability of public charging stations. Not everyone in the U.S. has access to a home garage or carport, so robust public infrastructure is a must.

That could be challenging for EV drivers, especially those who live in cold-weather climates. Therefore, the automotive middle ground – the hybrid electric vehicle – seemingly offers a viable solution. Hybrids feature many of the advantages of EVs, such as high efficiency, while also benefiting from existing public infrastructure because they run on hydrocarbons.

Sure enough, the data supports this narrative. Hybrid powerhouse Toyota (NYSE:TM) is looking at a record $30.3 billion in net profit for the fiscal year ending March. That’s largely due to rising sales of its popular hybrid vehicles. And as Valvoline’s website points out (gleefully, no doubt), hybrids require regular and consistent oil changes.

Toyota’s laughing its way to the bank. What’s good for Toyota is also good for Valvoline, making VVV stock an oddball but compelling investment.

Valvoline’s Valuation Is Better Than You Think

Currently, VVV stock trades at a trailing-year revenue multiple of 4.2x. That’s a bit hot compared to the oil and gas sector, but there’s a catch: it’s difficult to classify Valvoline’s business. Technically, you can say that the company is involved in the downstream component of the energy value chain. However, this subsegment largely deals with gasoline stations, which is not an apples-to-apples comparison with oil-change providers.

Nevertheless, what can be said with greater confidence is that the valuation is better than you think. Analysts project that by the end of the current fiscal year, Valvoline’s sales will hit $1.63 billion. That’s up 13.1% from last year’s haul of $1.44 billion.

Assuming a share count of 129.65 million, the sales multiple for VVV stock would drop to 3.28x. And it could be even better because the EV sector fallout should mean more business for Valvoline. If the actual sales come out far hotter than anticipated, then VVV would truly be intriguing.

Is Valvoline Stock a Buy, According to Analysts?

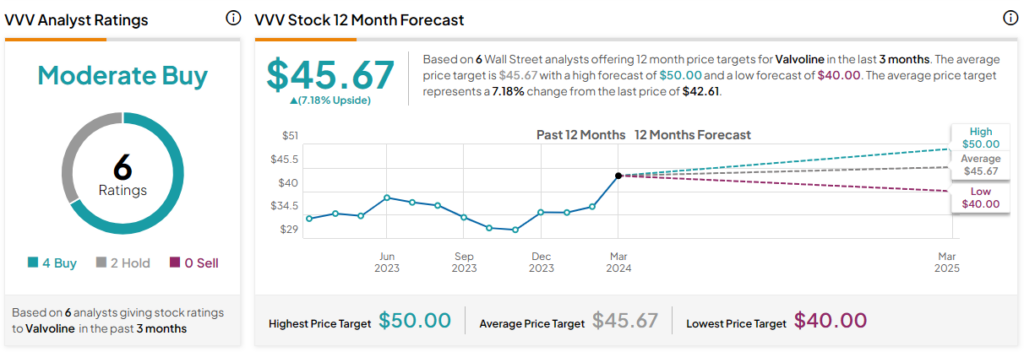

Turning to Wall Street, VVV stock has a Moderate Buy consensus rating based on four Buys, two Holds, and zero Sell ratings. The average VVV stock price target is $45.67, implying 7.2% upside potential.

The Takeaway: VVV Stock May Rise on the EV Sector’s Misfortunes

When EV sales were booming, that effectively spelled the eventual end for Valvoline. Electric-powered cars simply don’t require the same level of care and maintenance as combustion-powered vehicles. However, the sector’s misfortunes should translate to sustained demand for combustion cars, which means VVV stock is a better deal than you might be led to believe.