America’s largest package delivery company, United Parcel Service (NYSE:UPS), finally sealed the deal with the International Brotherhood of Teamsters. On August 22, the Teamsters Union disclosed that an overwhelming 86.3% of voting union members ratified the new five-year contract, worth approximately $30 billion over its full life. The majority vote averts the risk of a workers’ strike, which could have devastated the nationwide supply chain. It also puts an end to the year-long negotiations and ordeal between the two parties, which posed a huge risk for UPS’ business.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Terms of the New Five-Year Contract

Last month, both parties agreed to a tentative deal covering roughly 340,000 package delivery drivers and sorters for UPS. As per the terms of the contract, current workers would get a hike of $7.50 per hour over the five-year period, with $2.75 per hour effective immediately. Meanwhile, new part-time workers will get a revised salary of $21 per hour, a decent bump from the current $16.20 per hour offered.

Moreover, the agreement grants Martin Luther King Jr. Day as an additional paid holiday, ends compulsory overtime, and eliminates the two-tier wage system, bringing both newly recruited and old employees on the same scale. Plus, the company’s new vehicles will have air-conditioning systems starting next year.

Implications of the Negotiations

A Wall Street Journal report stated that, as per the U.S. Chamber of Commerce, UPS transports roughly 5% of the nation’s gross domestic product, translating to $3.8 billion worth of goods daily. The numbers illustrate the significant risk that could have affected the entire American supply chain if the agreement had been rejected.

In its latest second quarter Fiscal 2023 results, UPS lowered its revenue and its adjusted operating margin outlook for Fiscal 2023. The company cited “the volume impact from labor negotiations and the costs associated with the tentative agreement” as reasons for the revision in guidance.

Well, now that the worst is behind them, UPS will be looking to win back its lost customers that moved away because of the prospects of a strike. The company can now focus on expanding its business operations and gaining back its lost momentum. Amid the chaos, UPS stock has lost 5.5% in the last six months.

Is UPS a Buy or Hold, as per Analysts?

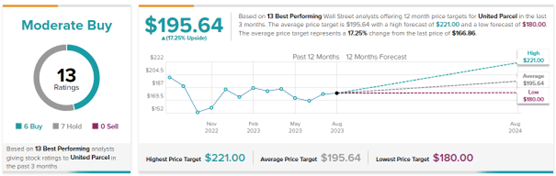

Wall Street remains cautiously optimistic about UPS’ stock trajectory. Of the 13 Top Analysts who recently rated UPS, six have given it a Buy rating, while seven have given it a Hold rating. Top Wall Street analysts are those awarded higher stars by TipRanks Star Ranking System. This is based on an analyst’s success rate, average return per rating, and statistical significance (number of ratings).

Based on these top analysts’ views, United Parcel Service stock has a Moderate Buy consensus rating on TipRanks. The average UPS price target of $195.64 implies 17.3% upside potential from current levels.