A long and bitter struggle between the International Brotherhood of Teamsters and UPS (NYSE:UPS) came to an end today, though investors weren’t exactly happy about how it all turned out. Despite reaching a tentative five-year agreement that keeps a strike off the table, investors sold off UPS stock sufficiently to send share prices down somewhat in Tuesday afternoon trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The Teamsters were cheerful about their new arrangement. Calling it “overwhelmingly lucrative,” the new agreement not only hikes wages for everybody but also requires UPS to do some more hiring at these expanded rates. Plus, a wide range of protective measures were added to the deal, to the point where the UPS Teamsters National Negotiating Committee endorsed the deal by unanimous accord. Now, all Teamster drivers get Martin Luther King Jr. Day as a full paid holiday, and both in-cab air conditioning and fans will be added to delivery vehicles across the spectrum, from full vans to package cars.

The deal averted a potential disaster, as a UPS strike could have hurt the entire economy. With UPS a part of business life in a thousand little ways—small parts are commonly shipped by UPS, so everything from repair-focused businesses to everyday plant maintenance depends on it—the loss of UPS for any length of time could have hamstrung the economy.

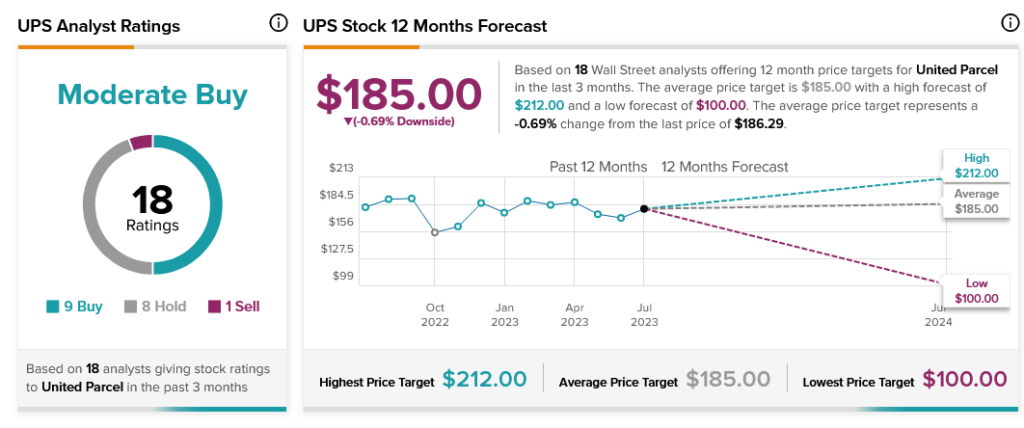

Analysts, however, are split on UPS’ overall fate. With nine Buy ratings, eight Holds, and one Sell, UPS stock is considered a Moderate Buy. However, with an average price target of $185 per share, UPS stock comes with fractional downside risk.