It’s pretty reliable that news of job cuts tends to improve share prices. It makes clear that management has the fortitude and the motivation to cut costs on a large scale, even if the human toll is catastrophic. However, that’s not what happened for UPS (NYSE:UPS), as the parcel delivery giant lost over 7% in Tuesday afternoon’s trading after announcing it would slash jobs.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

UPS had already taken a hit earlier this morning when it brought out its fourth-quarter earnings report and revealed that, despite a growing move to online shopping with the holiday season and more shipping accordingly, it still brought out a decline in earnings. Worse, the souring macroeconomic conditions came back to haunt it as well, as it revealed an outlook that wasn’t all that positive. In aid of that, UPS also announced plans to lay off 12,000 workers, which will save UPS about $1 billion annually. Further, UPS is considering selling off the Coyote truck leverage business, which was always “highly cyclical” anyway, reps noted.

Trouble With the Marketing?

A critical point that may be coming back to haunt UPS is possibly connected to the removal of the Chief Marketing Officer (CMO) position from its board. While CMOs tend not to last long in any given company, UPS took things one step further and completely eliminated the position. Marketing at UPS is now a part of the Chief Commercial and Strategy Officer’s role, who is now responsible for product management, revenue, strategy, and transformation operations. That’s a lot to have on any one plate, to begin with, and to add marketing to that suggests that UPS doesn’t especially care about marketing anymore, a move that might ultimately hinder it going forward.

Is UPS a Buy, Sell, or Hold?

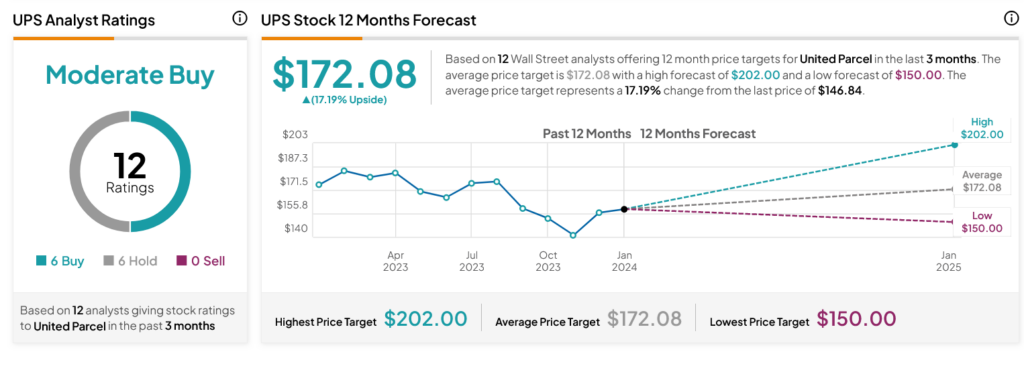

Turning to Wall Street, analysts have a Moderate Buy consensus rating on UPS stock based on six Buys and six Holds assigned in the past three months, as indicated by the graphic below. After a 17.75% loss in its share price over the past year, the average UPS price target of $172.08 per share implies 17.19% upside potential.