Logistics giant UPS (NYSE:UPS) declined in pre-market trading after the company’s fourth-quarter earnings and outlook left investors disappointed. The company announced fourth-quarter adjusted earnings of $2.47 per share, a decline of 31.7% year-over-year but slightly above consensus estimates of $2.46 per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company’s revenues also dropped by 7.8% year-over-year to $24.9 billion and missed consensus estimates of $25.4 billion. UPS saw its volumes drop due to an economic slowdown and labor disputes. The company’s volumes in the U.S. were down by 7.4%, while international volumes declined by 8.3% year-over-year in Q4.

However, the company’s Board of Directors raised its quarterly dividend to $1.63 per share on all outstanding Class A and Class B shares, which is payable on March 8 to shareholders of record on February 20.

Looking forward to FY24, UPS expects revenue to range from $92 billion to $94.5 billion with an adjusted operating margin between 10% and 10.6%. This estimate was below the Street’s expectations of an 11.3% operating profit margin and sales of $95.7 billion. The company is planning capital expenditures of around $4.5 billion and dividend payments of $5.4 billion in FY24.

Is UPS a Good Stock to Buy Now?

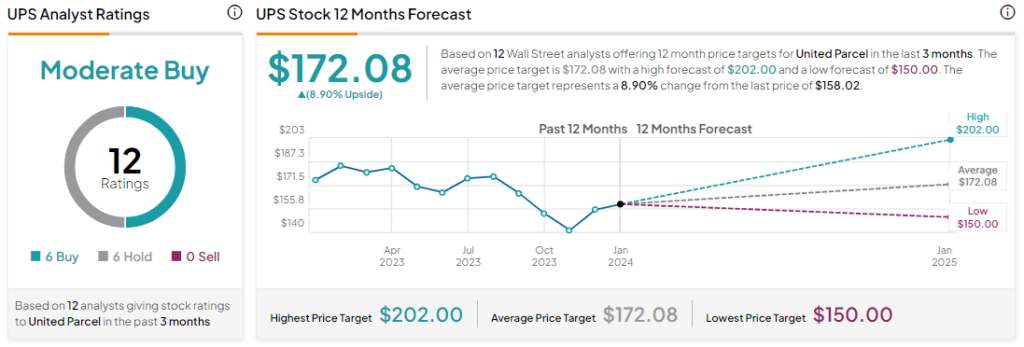

Analysts remain cautiously optimistic about UPS stock with a Moderate Buy consensus rating based on six Buys and Holds each. Over the past year, UPS stock has slid by more than 7%, and the average UPS price target of $172.08 implies an upside potential of 8.9% at current levels.