Transportation and technical training program provider Universal Technical Institute, Inc. (UTI) has agreed to acquire Concorde Career Colleges, Inc. from Liberty Partners.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Concorde’s healthcare education programs include diploma and degree programs in nursing, dental hygiene, and other direct patient care fields.

It currently caters to about 7,400 students across eight states and generated $180 million in revenue in 2021.

Management Weighs In

Troy Anderson, the CFO of Universal Technical, commented, “The $50 million purchase price provides a compelling enterprise value to adjusted EBITDA multiple and an opportunity to significantly increase our shareholder value. With the addition of Concorde and the broadening of our program offerings, we will accelerate Universal Technical Institute’s revenue, profitability, and cash flow growth over the next several years.”

The transaction is expected to close in the first half of fiscal 2023.

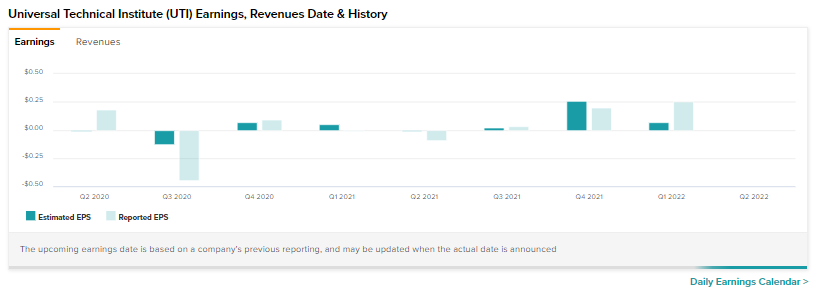

Furthermore, Universal is expected to post second-quarter numbers during after-market hours today. Analysts expect the company to post earnings per share of $0.02 on revenue of ~$96 million. It had garnered revenue of $77.7 million in the comparable year-ago period.

Analyst’s Take

Barrington analyst Alexander Paris has reiterated a Buy rating on the stock alongside a price target of $10. Overall, the Street has a Strong Buy Consensus rating on Universal based on three unanimous Buys.

At the time of writing, the average Universal price target was $11.67, which implies a potential upside of 12.3%. That’s on top of the 82.3% jump in the share price over the past 12 months.

Closing Note

The strategic move bolsters Universal’s education brand portfolio in healthcare programs and is in sync with Universal’s growth and diversification strategy.

Additionally, post this transaction, Universal sees 2025 revenue of over $700 million and an adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) margin of about 20%.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Onsemi Stock Rallies on Upbeat Q1 Results

Avis Budget Drives to Strong Q1 Results

Spirit Airlines Flies High with Frontier, JetBlue Deal Nosedives