Diversified health care services provider UnitedHealth Group (UNH) has delivered better-than-expected second quarter figures on its top line and bottom line.

Driven by double-digit growth across Optum and UnitedHealthcare, revenue rose 12.6% year-over-year to $80.3 billion, outperforming estimates by $620 million.

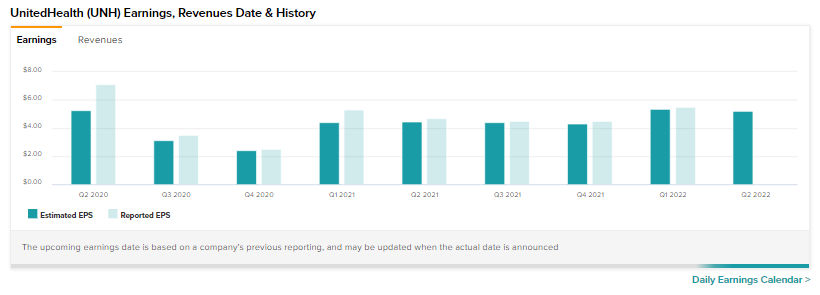

Earnings at $5.57 per share came in ahead of estimates by $0.36 per share. Most importantly, the company was able to expand its net margin by 30 basis points to 6.3% in Q2.

Furthermore, the medical care ratio came in at 81.5% versus 82.8% in the year-ago period due to the pandemic’s impact and business mix. Continued gains in productivity were also visible in the 14.6% operating cost ratio, which compares favorably to the year-ago figure of 14.5%.

The robust growth during the period came from an expanded number of people served at UnitedHealthcare and value-based arrangements from Optum. Optum caters to the global healthcare marketplace to improve the overall performance of the health system.

UNH’s Management Comments & Updated Guidance

The CEO of the company, Andrew Witty, commented, “Customers are responding as we build on our five growth pillars, enabling us to move into the second half of 2022 with strong momentum serving ever more people deeply.”

Buoyed by the Q2 showing, UNH now sees earnings landing between $21.40 per share and $21.90 per share for the full year. Notably, the revenue backlog for Optum Insight now stands at $23.6 billion.

Moreover, UNH returned $4 billion to investors via dividends and stock buybacks during the quarter while also increasing the dividend by 14% in June. The optimal capital deployment is also reflected in its second quarter return on equity of 27.9%.

Analysts Are Bullish about UNH

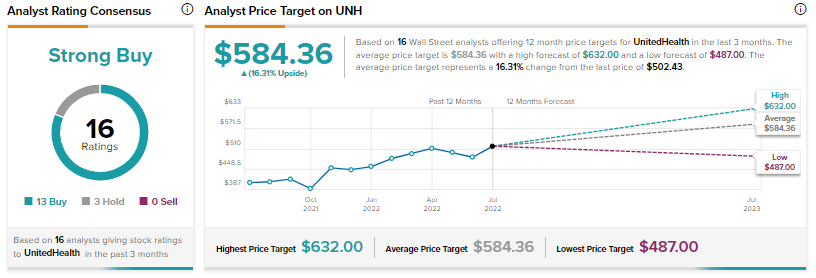

Yesterday, Morgan Stanley analyst Ricky Goldwasser reiterated a Buy rating on the stock alongside a price target of $570.

Overall, the Street has a Strong Buy consensus rating on the stock alongside an average price target of $584.36, which implies a 16.31% potential upside.

Closing Note

UNH continues to deliver robust performance. During the quarter, it served more than 600,000 people. This solid performance should further prop up the stock, which is already up 21.1% over the past year.

Read the full Disclosure