United Airlines (NASDAQ:UAL) is scheduled to announce its fourth-quarter earnings today, January 17, after the market close. A rebound in air travel demand is likely to have supported the company’s performance.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Currently, the Street expects United Airlines to post earnings of $2.11 per share in Q4, compared with a loss of $1.60 in the prior-year period. Meanwhile, revenue expectations are pegged at $12.2 billion, representing a year-over-year jump of about 49%.

Factors Likely to Have Impacted Q4

The company is expected to have benefitted from a recovery in commercial travel demand. Moreover, continued momentum in leisure travel might have aided topline growth. As per the International Air Transport Association (IATA), total air traffic in the months of October and November increased by 44.6% and 41.3%, respectively, on an annual basis.

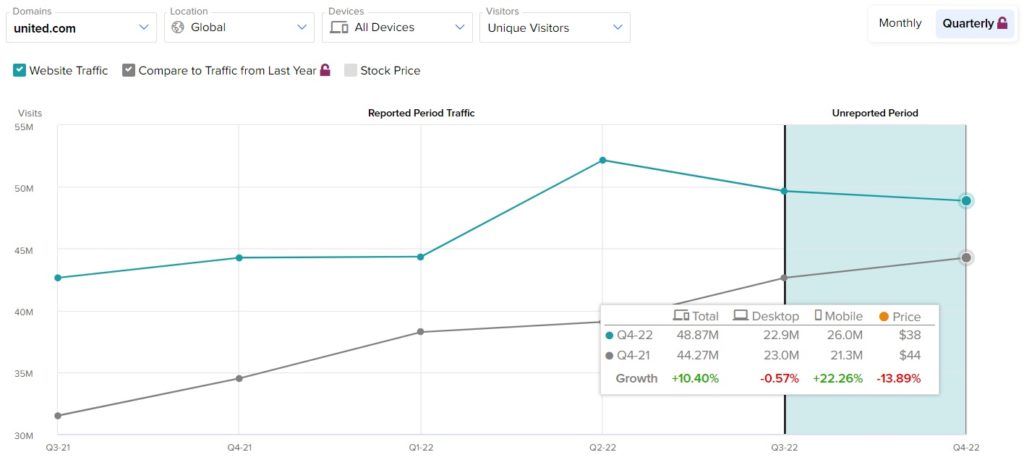

According to TipRanks’ Website Traffic Tool, the United Airlines website traffic increased 10.4% year-over-year in Q4. The spike in global website visits hints at the fact that demand for the company’s services remains robust.

On the flip side, volatile aircraft fuel costs and salary hikes paid to the pilots are likely to have impacted United Airlines’ bottom line to some extent. Also, its performance in Q4 was impacted by bad weather during the peak holiday season.

Learn more about TipRanks’ unique Website Traffic tools in a special webinar, this Wednesday, January 18, at 9:00 a.m. EST. Click here to sign up.

Is United Airlines a Good Stock to Buy?

The stock has a Moderate Buy consensus rating based on seven Buys, two Holds, and one Sell. The average UAL stock price target of $56.20 implies 9.1% upside potential. The stock has gained nearly 43% in the past three months.