Wisconsin-based Oshkosh (OSK) makes mission-critical equipment. The company has a global footprint, selling its products in more than 150 countries.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Let’s take a look at the company’s latest financial performance, corporate updates, and newly added risk factors. (See Oshkosh stock charts on TipRanks).

Fiscal Q3 Financial Results

Oshkosh reported revenue of $2.21 billion for its Fiscal 2021 third-quarter ended June 30. That compared to $1.58 billion in the same quarter last year and matched the consensus estimate. Adjusted EPS of $2.09 increased from $1.29 a year ago but missed the consensus estimate of $2.26.

For the full year of Fiscal 2021, Oshkosh revised its adjusted EPS outlook to a range of $6.35 to $6.50, compared to previous guidance of $6.35 to $6.85.

Corporate Updates

Oshkosh’s subsidiary Pierce Manufacturing has purchased an ownership stake in Boise Mobile Equipment (BME), a maker of equipment used by firefighters. The arrangement will allow Pierce and BME to collaborate in developing and marketing wildland products.

Oshkosh has made a strategic investment in robotics and artificial intelligence studio Carnegie Foundry. They plan to partner to accelerate innovation in the robotics and autonomy space. Oshkosh said the arrangement complements its current work in autonomous vehicles and equipment.

“The Carnegie Foundry team is comprised of industry leaders with outstanding expertise in autonomy…strategic investment in Carnegie Foundry will put our customers at the forefront of emerging innovation and technology in the robotics and autonomy space,” said Oshkosh CEO John Pfeifer.

Risk Factors

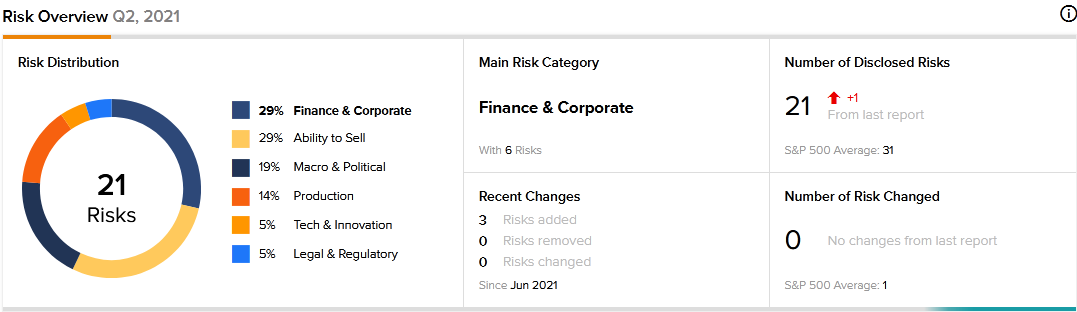

The new TipRanks Risk Factors tool shows 21 risk factors for Oshkosh. Since filing its Fiscal 2020 annual report, the company has updated its risk profile with three new risk factors.

Oshkosh tells investors that it continuously evaluates potential acquisitions. Although it performs due diligence, Oshkosh cautions that it cannot assure that it will achieve the anticipated benefits from the businesses it acquires.

The company says that the U.S. Postal Service (USPS) has contracted it to produce next-generation delivery vehicles. The USPS has committed to purchase at least 50,000 vehicles and as many as 165,000 vehicles over a 10-year period. But the company cautions that certain circumstances, such as interference by Congress, could lead to the USPS purchasing fewer vehicles than expected. That could harm Oshkosh’s ability to recover the investments made in relation to the USPS contract.

Oshkosh warns that the consolidation of its customer base may adversely impact its business. For example, when customers consolidate, they may have greater leverage in negotiating product prices. That could, in turn, cause an unfavorable impact on the company’s margins.

The majority of Oshkosh’s risk factors fall under the Finance and Corporate and the Ability to Sell categories, each accounting for 29% of the total risks. For the Finance and Corporate risk category, the sector average is 39%. The Ability to Sell risk category’s sector average is 11%. Oshkosh’s stock price has gained about 23% since the beginning of 2021.

Analysts’ Take

In September, KeyBanc analyst Steve Barger reiterated a Buy rating on Oshkosh stock but lowered the price target to $125 from $144. Barger’s new price target suggests 17.75% upside potential.

Consensus among analysts is a Strong Buy based on 6 Buys and 2 Holds. The average Oshkosh price target of $136.88 implies 28.94% upside potential to current levels.

Related News:

Globant Acquires Atix Labs to Expand Blockchain Offering

J & J Applies for Emergency Use Authorization for COVID-19 Booster

Dominion to Vend Questar Pipelines to Southwest Gas