Medical device company Dynatronics Corp. (DYNT) is a manufacturer of athletic training, physical therapy and rehabilitation products. Recently, the company delivered better-than-expected fourth-quarter fiscal 2021 results.

Let’s look at Dynatronics’ recent financials and understand what has changed in its key risk factors that investors should know.

Dynatronics’ fourth-quarter sales jumped 50.8% year-over-year to $12.24 million and surpassed the Street’s estimates by $123,000.

The CEO of Dynatronic, John Krier, said, “Customer and dealer reaction to Dynatronics’ optimization strategy confirmed the changes and decisions we made in April 2021, and our transformation remains the top priority.

“We anticipate good progress in fiscal 2022, with revenues benefitting from our growing markets as we work to improve margins and build long-term value for our shareholders.”

During the quarter, its gross margin expanded to 19.1% from 17.4% a year ago. The selling, general and administrative expenses increased to $4.6 million from $3.6 million a year ago.

Despite the higher expenses, other income (consisting of PPP loan forgiveness, employee retention credit and gain on the sale of Tennessee manufacturing facility) of $5.1 million helped the company post earnings per share of $0.16 in the fourth quarter, surpassing the Street’s estimates by $0.13 per share. Dynatronics had posted a net loss of $0.18 per share in the same quarter last year. (See Dynatronics stock chart on TipRanks)

Looking ahead, for the first quarter of fiscal 2022, Dynatronics expects to achieve net sales of $11.5 million to $12 million. It anticipates SG&A expenses at 30% to 35% of net sales.

Importantly, Dynatronics and its customers expect to witness challenges due to the COVID-19 pandemic. These challenges include higher delivery and shipment costs, supply chain disruptions and extended handling times. The company also expects some volatility from its optimization initiative.

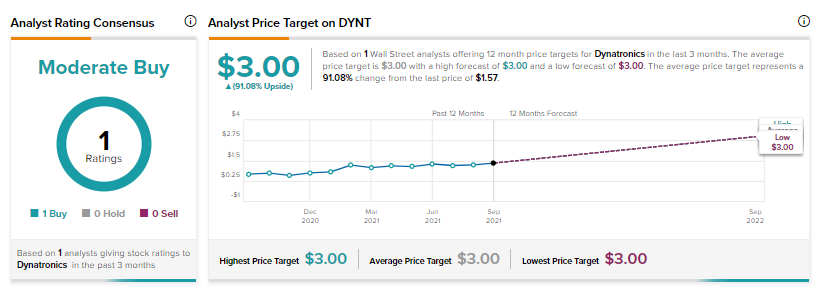

On September 23, Maxim Group analyst Anthony Vendetti reiterated a Buy rating on the stock and increased the price target to $3 from $2, implying upside potential of 91%.

The analyst said, “DYNT’s business optimization and stock-keeping unit (SKU) rationalization plan that it undertook at the end of April 2021 has been well-received by both customers and dealers.”

Now, let’s look at what’s changed in the company’s key risk factors.

According to the new Tipranks’ Risk Factors tool, Dynatronics’ main risk category is Finance & Corporate, which accounts for 39% of the total 36 risks identified. Since June, the company has changed two key risk factors under the Finance & Corporate risk category.

Dynatronics notes that it has a history of losses and may not be able to sustain profitability in the future. The company has incurred net losses for nine of the last 10 fiscal years, and it may not be able to increase its top-line in the future. Further, its revenue could decline or grow at a slower-than-expected pace.

The second risk factor pertains to the concentration or potential concentration of equity ownership in Dynatronics by Prettybrook Partners LLC and its affiliates, who have 15% of voting power in Dynatronics. The company states that this may limit the stockholders’ ability to influence corporate matters.

Dynatronics further acknowledges that concentration of power may discourage others from initiating changes of control. In such a scenario, the perception of Dynatronics’ prospects and the price of its common stock may get impacted.

The Finance & Corporate risk factor’s sector average is at 29%, compared to Dynatronics’ 39%. Shares are up 93.8% so far this year.

Related News:

Darden Shares Set a New Record High on Stellar Q1 Results

Salesforce Impresses at Investor Day; Shares Hit a New High

Vail Resorts Sinks on Mixed Q4 Results