Brunswick (BC) is an American company that manufactures recreational marine products. It operates in 24 countries and is in the process of acquiring marine electronics and sensors maker Navico for $1.05 billion. The transaction is expected to close in the second half of 2021.

Let’s take a look at the company’s latest financial performance, corporate updates, and changes in risk factors. (See Brunswick stock charts on TipRanks).

Q2 Financial Results and 2021 Guidance

Brunswick’s revenue increased 57.4% year-over-year to $1.55 billion in Q2 2021 and beat consensus estimates of $1.5 billion. Adjusted EPS of $2.52 increased from $0.99 in the same quarter last year and beat consensus estimates of $2.14. Brunswick ended Q2 with $590.2 million in cash.

For Q3, the company expects year-over-year revenue growth of mid-teens percent and EPS growth of high-single-digit percent. Brunswick anticipates 2021 full-year revenue in the band of $5.65 billion to $5.75 billion and adjusted EPS of $8.00. The forecast excludes the potential benefits from the Navico acquisition.

Corporate Updates

Brunswick increased its borrowing capacity under its revolving credit facility to $500 million from $400 million. The expanded revolving credit facility will be available to the company through July 2026.

Brunswick has expanded its share repurchase authorization and now has more than $400 million approved for the program. During Q2, the company made $55.9 million in share repurchases.

Risk Factors

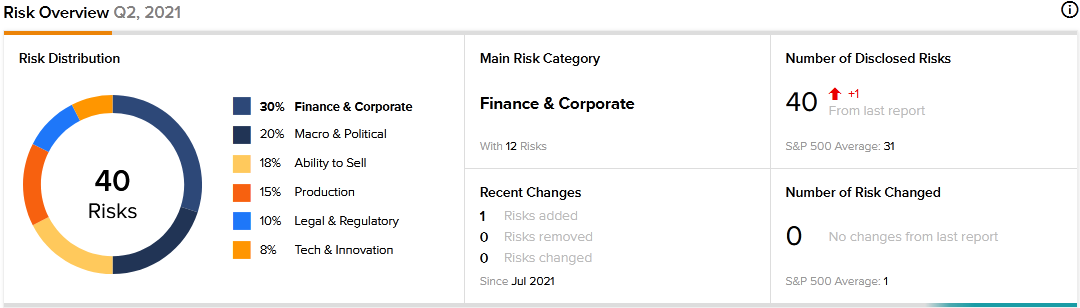

The new TipRanks Risk Factors tool shows that since Q4 2020, Brunswick’s risk factors have increased to 40 from 39. The company added a new risk factor under the Finance and Corporate category related to the pending Navico acquisition.

Brunswick tells investors that certain events could prevent it from closing the Navico acquisition, but if it completes the acquisition, there is no guarantee that the integration will be as successful as expected. Brunswick warns that its results may be adversely impacted if it fails to close the Navico acquisition or fails to realize the anticipated benefits of the transaction.

The majority of Brunswick’s risk factors fall under the Finance and Corporate category, with 30% of the total risks. That is below the sector average of 38%. Brunswick stock has gained about 28% year-to-date.

Analysts’ Take

In August, B.Riley Financial analyst Eric Wold reiterated a Buy rating on Brunswick stock with a price target of $135. Wold’s price target suggests 38.66% upside potential.

Consensus among analysts is a Moderate Buy based on 4 Buys, 2 Holds, and 1 Sell. The average Brunswick price target of $111.71 implies 14.74% upside potential to current levels.

Related News:

Allstate Concludes Sale of New York Life & Annuity Businesses

Keurig Dr Pepper’s Board Authorizes New Share Repurchase Program

Avalara Acquires Track1099; Street Says Buy