Apyx Medical (APYX) is an American medical devices company. It sells a product called J-Plasma to the hospital surgical market and Renuvion to the cosmetic surgery market. The company has a global footprint and operates through two segments named Advanced Energy and OEM. (See Insiders’ Hot Stocks on TipRanks)

Let’s take a look at Apyx Medical’s latest financial performance, corporate updates, and changes in its risk factors.

Q2 Financial Results and 2021 Outlook

Apyx Medical reported revenue of $11.2 million for Q2 2021. That increased from $4.3 million in the same quarter last year and exceeded the consensus estimate of $8.86 million. Advanced Energy revenue increased 248% year-over-year to $10 million, but OEM revenue declined 13% year-over-year to $1.2 million.

The company generates the majority of its revenue in the U.S., with domestic revenue increasing 118% year-over-year to $7.4 million in Q2. International revenue increased 325% year-over-year to $3.8 million.

Apyx Medical posted a loss per share of $0.12. That narrowed from a loss per share of $0.14 in the same quarter last year and beat the consensus estimate of a loss per share of $0.15. The company ended Q2 with $34.7 million in cash.

Apyx Medical plans to report its Q3 financial results on November 11. For full-year 2021, the company raised its revenue estimate to a range of $40.6 million to $42.6 million. Revenue was $27.7 million in 2020. Previous estimates called for revenue in the band of $37.6 million to $39.7 million. The company anticipates a 2021 loss in the range of $19.3 million to $18 million compared to a loss of $11.9 million in 2020. (See Apyx Medical stock charts on TipRanks).

Corporate Updates

Apyx Medical is looking to expand the role of its Renuvion device in the cosmetic surgery market. The company has submitted a premarket notification to the FDA for the use of Renuvion for certain clinical indications in dermal resurfacing procedures.

Apyx Medical has appointed former Johnson & Johnson (JNJ) and Novartis (NVS) executive Wendy Levine to its board of directors. Levine is an expert in marketing and advertising in the healthcare sector. Apyx Medical expects to benefit from her experience in developing consumer marketing strategies.

Risk Factors

Since June 2021, Apyx Medical has updated its risk profile with one new risk factor. As a result, the total risk factors identified for the company have increased to 21 from 20 previously, according to the new TipRanks Risk Factors tool.

In the newly added risk factor under the Production category, Apyx Medical highlights supply-chain challenges. The company says it relies on a network of suppliers to provide it with components and raw materials for its manufacturing operations. It also depends on third-party freight carriers to ship those components and materials to its manufacturing sites. If there are delays in the supply and shipment of those items, it may be forced to delay production schedules. The problem is that altering production schedules could result in revenue loss due to its inability to meet customer demand.

The majority of Apyx Medical’s risk factors fall under the Legal and Regulatory, and Production categories, with each representing 24% of the total risks. That is above the sector average of 20% for the Legal and Regulatory risk factor and 11% for the Production risk factor. Apyx Medical’s stock price has gained about 86% since the beginning of 2021.

Analysts’ Take

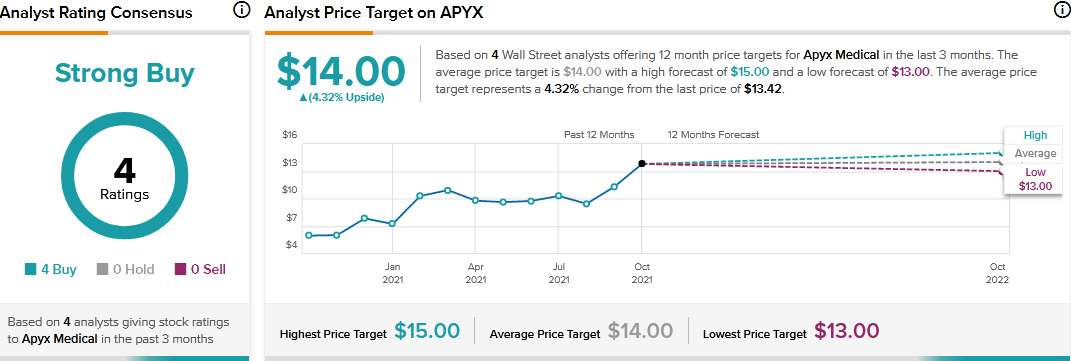

In August, JMP Securities analyst David Turkaly reiterated a Buy rating on Apyx Medical stock and raised the price target to $14 from $12.

Consensus among analysts is a Strong Buy based on 4 Buys. The average Apyx Medical price target of $14 implies 4.32% upside potential to current levels.

Related News:

Boston Beer Delivers Mixed Q3 Results; Shares Slip 3.3% After-Hours

A Look at MSC Industrial’s Risk Factors

Vicor’s Quarterly Results Disappoint; Shares Drop 4% After-Hours