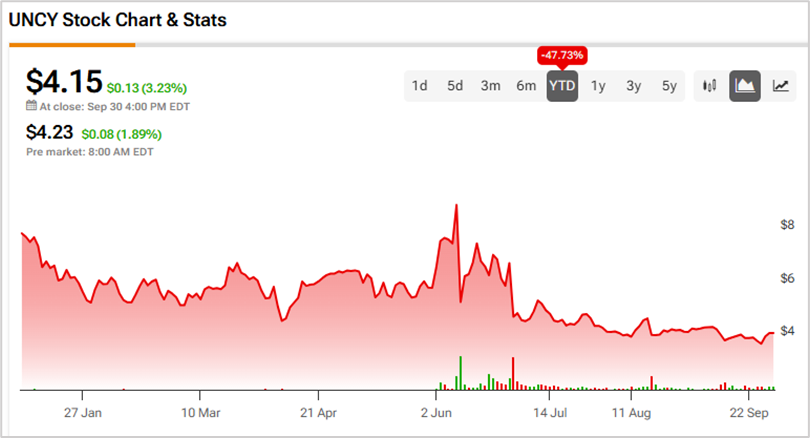

A class action lawsuit was filed against Unicycive Therapeutics (UNCY) by Levi & Korsinsky on August 15, 2025. The plaintiffs (shareholders) alleged that they bought UNCY stock at artificially inflated prices between March 29, 2024, and June 27, 2025 (Class Period) and are now seeking compensation for their financial losses. Investors who bought Unicycive stock during that period can click here to learn about joining the lawsuit.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Unicycive is an American biotechnology company focused on developing novel treatments for kidney diseases. The company’s lead drug candidate, oxylanthanum carbonate (OLC), is a next-generation phosphate binder for dialysis patients with chronic kidney disease (CKD). It matches the phosphate-binding capacity of existing drugs but comes in smaller, easier-to-swallow tablets with better tolerability.

The company submitted a New Drug Application (NDA) for OLC to the U.S. Food and Drug Administration (FDA) in September 2024. Its claims of receiving FDA approval for the NDA are at the heart of the current complaint.

Unicycive’s Misleading Claims

According to the lawsuit, Unicycive and two of its senior officers (the Defendants) repeatedly made false and misleading public statements throughout the Class Period. In particular, they are accused of omitting truthful information about Unicycive’s readiness and ability to satisfy the FDA’s manufacturing compliance requirements, and ancillary issues, from SEC filings and related material.

During the Class Period, the defendants kept reiterating the importance of OLC’s clinical trials and subsequent NDA approval. For instance, the CEO stated in a press release that completing enrollment in the pivotal oxylanthanum carbonate trial was a major milestone. He was confident OLC could become a best-in-class treatment for hyperphosphatemia in CKD patients on dialysis, with topline data due late Q2 and NDA filing planned soon after.

Additionally, in its annual report, Unicycive stated that it plans to continue using third-party service providers, including contract manufacturing organizations, for the production and supply of materials during product development and commercialization.

Finally, in a June 2024 conference call, the CEO noted that the company was ready for manufacturing scale-up, having tested validated batches at multi-hundred-kilogram levels, with no issues.

However, subsequent events (detailed below) revealed that the defendants overstated the regulatory prospects of oxylanthanum carbonate’s NDA.

Plaintiffs’ Arguments

The plaintiffs maintain that the defendants deceived investors by lying and withholding critical information about the company’s business during the Class Period. Importantly, the defendants failed to inform investors of compliance deficiencies at their third-party manufacturing vendors, which could hinder the NDA process.

The information became clear in a series of events that occurred between June 10, 2025 and June 30, 2025. Unicycive issued a press release providing an update on its NDA for OLC to treat hyperphosphatemia in CKD patients on dialysis.

Additionally, Unicycive disclosed that following an FDA inspection, deficiencies in current Good Manufacturing Practice (cGMP) compliance were found at a third-party subcontractor of Unicycive’s contract development and manufacturing organization (CDMO). Due to these issues, any label discussions between the FDA and the company were halted.

Finally, on June 30, 2025, Unicycive issued a press release announcing that the FDA had issued a Complete Response Letter (CRL) for the oxylanthanum carbonate NDA, citing the previously identified cGMP deficiencies at a third-party subcontractor of its CDMO. Following the news, UNCY stock plunged nearly 30% the same day.

To conclude, the defendants failed to inform investors of the potential issues that could arise from the third-party contract manufacturing practices. Due to these issues, UNCY stock has lost 47.7% so far this year.