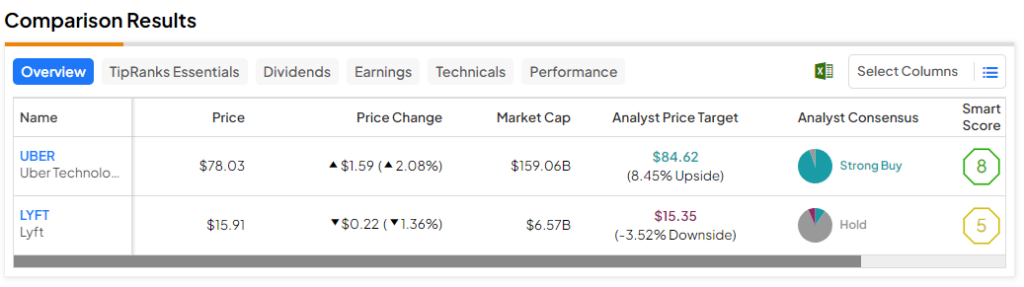

In this piece, I evaluated two ridesharing stocks, Uber Technologies (NYSE:UBER) and Lyft (NASDAQ:LYFT), using TipRanks’ comparison tool to see which is better. A closer look suggests a bullish view for Uber and a bearish view for Lyft.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Uber Technologies is a transportation networking company that offers a ridesharing service, a food-delivery business called Uber Eats, and a freight business called Uber Freight. Similarly, Lyft operates as a ridesharing platform, providing users with a service to book personal rides via its mobile app.

Shares of Uber Technologies have gained 24% year-to-date and have a one-year return of 120%. Meanwhile, Lyft stock is up 8% year-to-date, bringing its one-year gain to 50%.

With such a dramatic difference in their year-to-date performances, it’s not a surprise that one of these companies is profitable while the other is not. Since Lyft is not profitable, we’ll compare both companies’ price-to-sales (P/S) ratios to gauge their valuations against each other and that of their industry.

For comparison, the transportation industry is trading around its three-year average P/S of 2.8.

Uber Technologies (NYSE:UBER)

At a P/S of 4.3, Uber Technologies is trading at a premium to its industry and to Lyft. However, Uber’s long-term share-price action, uber-bullish guidance, and share repurchase authorization suggest a bullish view may be appropriate, albeit with a note of caution.

The big news for Uber Technologies is the guidance it provided at its virtual investor update earlier this month, which triggered multiple price-target increases. The company introduced new three-year guidance suggesting that its bookings would see compounded growth between the high teens and 20%, while its EBITDA would compound growth in the high 30% to 40% range.

Uber also said it expects to convert more than 90% of its EBITDA to free cash flow. Additionally, the company announced its first-ever share repurchase authorization for $7 billion worth of shares, which should drive further upside in its share price.

Uber does appear to have the fundamentals to back up those projections, having just become fully profitable on an annual basis in 2023. It has also been smashing earnings estimates over the last several quarters. In the most recent quarter, Uber grew its gross bookings by 22% year-over-year to $37.6 billion, and its revenue by 15% year-over-year to $9.9 billion.

Finally, turning to its valuation, Uber’s P/S ratio is slightly below its mean P/S of 4.4 since May 2019, although that includes the pandemic period, during which Uber’s P/S shot up to 10. At that time, the company wasn’t profitable, but now that it is, I wouldn’t be surprised if its share price continued to trend upward as its P/S multiple expands.

Given that Uber essentially sits at the crossroads between technology and transportation, it does deserve a bit of a premium versus the transportation industry. However, the company’s valuation should be monitored as its stock price rises because it could quickly become too expensive.

Thus, strict value investors might want to leave it alone, although investors who can stomach the risk could see some nice returns on Uber stock in the near term.

What Is the Price Target for UBER Stock?

Uber Technologies has a Strong Buy consensus rating based on 36 Buys, two Holds, and zero Sell ratings assigned over the last three months. At $84.32, the average Uber Technologies stock price target implies upside potential of 8.1%.

Lyft (NASDAQ:LYFT)

At a P/S of 1.5, Lyft is trading at a discount to the transportation industry, although it still isn’t profitable. However, insider sales suggest there might not be much more upside in the near term, so a bearish view seems appropriate, at least for now.

Following the latest earnings release, Lyft stock initially skyrocketed more than 60% after a typo in its earnings release stated that the company expected its adjusted EBITDA margin to expand by 500 basis points year-over-year, or 5%. However, the real number should’ve been 50 basis points — or 0.5%.

Aside from that glaring error, Lyft’s earnings results weren’t horrible. The company reported earnings of 19 cents per share on $1.22 billion in revenue versus expectations of 8 cents per share on $1.22 billion in revenue.

However, the growing number of Auto Sell transactions by insiders as the company’s stock has risen over the last three months suggests they don’t see any more near-term upside for the stock. In their pre-set trading plans, it’s not uncommon for insiders to set prices at which to automatically sell their company’s stock when it reaches a certain price. As such, now that Lyft stock has spiked even further, it wouldn’t be surprising to see more insider sales.

At some point, I might become more constructive on the stock if or when the company becomes fully profitable. At its current valuation, Lyft looks quite attractive but for now, there are just too many question marks.

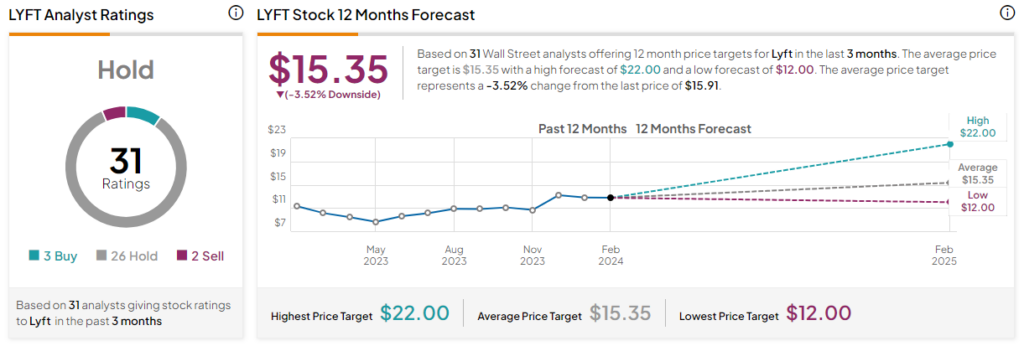

What Is the Price Target for LYFT Stock?

Lyft has a Hold consensus rating based on three Buys, 26 Holds, and two Sell ratings assigned over the last three months. At $15.35, the average Lyft stock price target implies downside potential of 3.5%.

Conclusion: Bullish on UBER, Bearish on LYFT

The competition between Uber Technologies and Lyft has been a key one to watch over the last several years, but for now, Uber seems like the clear winner. It was the first to become profitable, and it shared a very attractive outlook that wasn’t actually a mistake.

However, things could shift very suddenly with either of these stocks. If Uber shares soar too high too quickly or if it disappoints with its results in any way, some profit-taking would be in order. On the other hand, Lyft could eventually earn some meaningful share-price appreciation at some point, but it’s just not there yet.