Shares of Chinese e-commerce and cloud computing giant Alibaba (BABA) have jumped more than 43.5% over the past month, bringing the year-to-date rally to 108%. Aggressive spending on artificial intelligence (AI)-led growth initiatives, partnership with U.S. chip giant Nvidia (NVDA), and new AI offerings are driving BABA stock higher. However, a U.S. Tiger Securities analyst downgraded Alibaba stock to Hold from Buy, as he believes that the risk-reward has become less favorable following the recent rally. That said, several other analysts boosted their price targets for BABA stock and reiterated their bullish stance.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

U.S. Tiger Securities Moves to the Sidelines on BABA Stock

U.S. Tiger Securities analyst Bo Pei downgraded Alibaba stock from Buy to Hold, but increased the price target to $180 from $145. The analyst attributed the spike in BABA stock price to renewed investor optimism about the company’s AI/cloud pivot following the recent quarterly results, encouraging corporate announcements, and improved sentiment on Chinese tech stocks.

Pei explained that while he remains “constructive” on the mid- to long-term trajectory of Alibaba’s AI, cloud, and platform investments, he believes that much of the upside has already been priced into the stock. In fact, Pei believes that following the recent rally, BABA stock is more vulnerable to a possible downside from current levels. He noted that BABA stock is now trading at a valuation multiple of 13.3x next-12 months EBITDA (earnings before interest, taxes, depreciation, and amortization), essentially in line with Amazon’s (AMZN) 13.0x, removing the valuation cushion that previously supported his bullish stance.

Other Analysts Boost BABA Stock Price Target

Unlike Pei, Citi analyst Alicia Yap reiterated a Buy rating on BABA stock and increased the price target to $217 from $187. The 4-star analyst raised her cloud revenue and capex assumptions based on the onsite attendees’ traffic at Alibaba’s Apsara Conference and the company’s optimistic projection of a tenfold increase in data center capacity in response to accelerating AI cloud demand.

Yap called Alibaba “one of the 5-6 global super cloud platforms with full-stack AI services.” She believes that Alibaba is well-positioned for sustainable growth in cloud revenue.

Likewise, Bank of America Securities analyst Joyce Ju increased his price target for Alibaba stock to $195 from $168 and reaffirmed a Buy rating following the annual flagship event, the Apsara Conference, this week. He noted the increased AI investment and cloud computing budget that CEO Eddie Wu announced as the company embraces the era of Artificial Superintelligence (ASI).

“Eyeing the huge opportunity in the new ASI era, the company positions itself as the world’s leading full-stack AI services provider to offer best-class large models, global AI cloud network, as well as an open and developer-friendly ecosystem,” said the analyst.

Is BABA Stock a Good Buy?

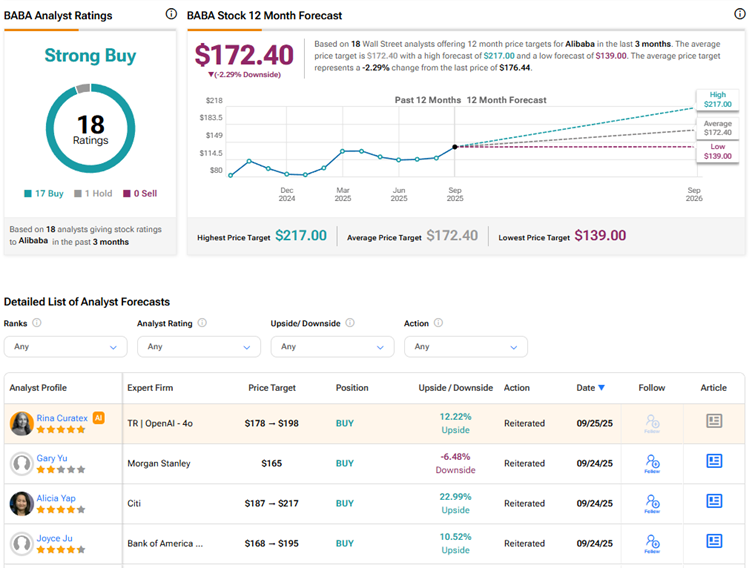

Overall, Wall Street has a Strong Buy consensus rating on Alibaba stock based on 17 Buys and one Hold recommendation. The average BABA stock price target of $172.40 indicates a possible downside of 2.3% from current levels.