Shares of Alibaba Group (BABA) (HK:9988) soared to a four-year high of HK$174.60 today after CEO Eddie Wu unveiled ambitious plans to boost AI investment beyond $50 billion. Speaking at the company’s annual conference in Hangzhou, Wu reaffirmed the commitment announced in February, to spend more than 380 billion yuan ($53 billion) over the next three years to develop advanced AI models and infrastructure.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

As part of this push, Alibaba announced the launch of its new large-scale AI model, the Qwen3-Max, aimed at strengthening its position in the fast-changing AI race. Alibaba Cloud CTO Zhou Jingren revealed that the model has more than 1 trillion parameters and is designed to excel in code generation and autonomous agent capabilities.

Alibaba Doubles Down on AI Expansion

Wu expects global AI investment to reach about $4 trillion in the next five years. To keep pace, Alibaba plans to increase its spending beyond an earlier commitments and position itself as a “full-stack AI service provider,” building both services and the infrastructure to power them. The company’s cloud division, which already serves regions from the U.S. to Australia, will open new data centers in Brazil, France, and the Netherlands within the next year.

According to Bloomberg Intelligence, the total AI-related capital spending from China’s tech giants, including Alibaba, Baidu (BIDU), Tencent (TCHEY), and JD.com (JD), is expected to exceed $32 billion this year, more than double the $13 billion spent in 2023.

Challenges and Global Competition

Despite the heavy investments, Chinese companies face headwinds due to limited access to Nvidia’s (NVDA) advanced AI chips, pushing them to accelerate the use of in-house semiconductors. Alibaba recently won a major contract from leading wireless carrier, China Unicom, to deploy its own Pingtouge or “T-Head” AI accelerators.

Alibaba’s aggressive AI strategy puts it in direct competition with U.S. tech leaders such as Amazon (AMZN), Alphabet (GOOGL), Meta (META) and Microsoft (MSFT). These companies are reportedly spending a total of up to $320 billion on AI technologies and data center expansion this year.

Is BABA Stock a Buy, Hold, or Sell?

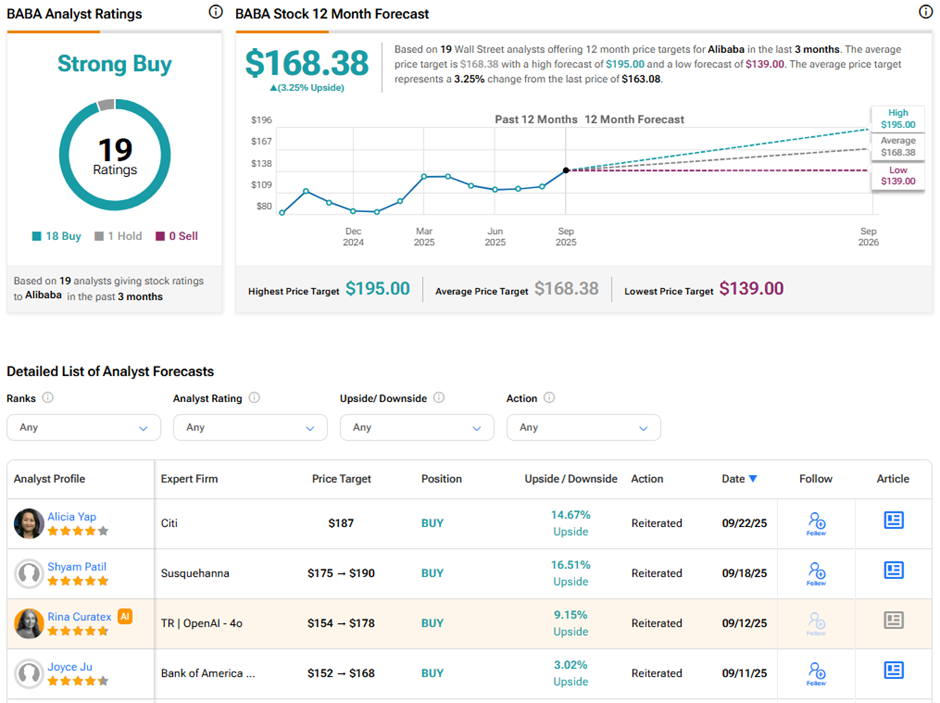

On TipRanks, BABA stock has a Strong Buy consensus rating based on 18 Buys and one Hold rating. The average Alibaba price target of $168.38 implies 3.3% upside potential from current levels. Year-to-date, BABA stock has surged nearly 96%.