United States Steel Corporation (NYSE:X), or U.S. Steel, reported better-than-expected results for the third quarter of 2023. However, the metrics compared unfavorably with the prior-year quarter due to lower average prices.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

The company reported Q3 adjusted net earnings of $1.40 per share, which surpassed analysts’ expectations of $1.12. Nevertheless, it declined 29.3% from the year-ago quarter. Meanwhile, U.S. Steel’s net sales decreased by 14.8% year-over-year, amounting to $4.43 billion, but exceeded the consensus estimate of $4.39 billion.

The company’s performance was impacted by lower earnings before interest and income taxes (EBIT) in the Flat-Rolled and Tubular segments, partially offset by higher earnings in the Mini Mill unit. Also, a lower loss in the U.S. Steel Europe segment aided results.

In the just reported quarter, U.S. Steel recorded lower average realized prices for all four segments. Moreover, Q3 steel shipments fell for Flat-Rolled and Tubular segments while increasing for the remaining two.

What is the Future of X Stock?

It is worth mentioning that earlier this month, U.S. Steel was in the news for exploring a potential sale, including a bid from Cleveland-Cliffs (CLF), which the company rejected. It’s quite possible that U.S. Steel could attract more bids from potential buyers, given its recent financial performance.

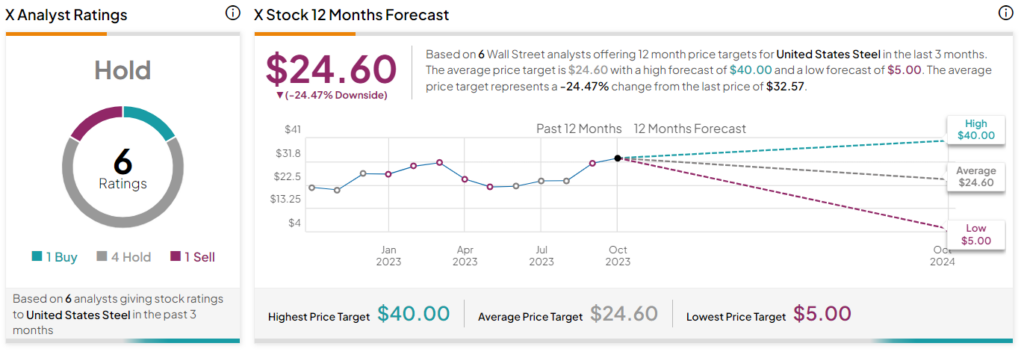

The stock sports a Hold consensus rating on TipRanks, based on one Buy, four Hold, and one Sell recommendations. Further, analysts’ average price target of $24.60 implies 24.47% downside potential.