U.S. authorities are mulling expanding an emergency lending facility to extend more support to banks, mainly with the intention of giving First Republic Bank (NYSE:FRC) more time to strengthen its balance sheet, Bloomberg reported.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Several options, including the expansion of an emergency lending facility, are being evaluated in the early stage of discussions. Shares of First Republic have declined nearly 90% over the past one month over liquidity concerns. In mid-March, a consortium of banks, including JPMorgan Chase (NYSE:JPM) placed $30 billion in deposits at First Republic. Nonetheless, investors remain unsettled due to the collapse of Silicon Valley Bank and Signature Bank.

Sources told Bloomberg that even without the expansion of emergency lending, regulators feel that First Republic is stable enough to function without any immediate intervention, with the company and its advisers trying to work out a deal to shore up its balance sheet.

Last week, Reuters reported that First Republic was exploring options to downsize and sell some of its business, including a part of its loan book, to raise cash and reduce costs. The bank is trying to address its negative book value (the gap between liabilities and assets), which is estimated to be in the range of $9.4 billion and $13.5 billion.

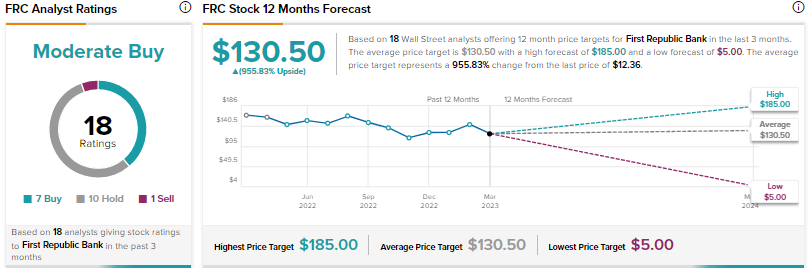

Is FRC Stock a Buy?

Given the uncertainty surrounding First Republic Bank, it could be prudent for investors to avoid the stock as of now. Wall Street’s Moderate Buy consensus rating for FRC stock is based on seven Buys, 10 Holds, and one Sell. The average price target of $130.50 indicates significant upside, given the steep decline in the stock.