The U.S. dollar, long the world’s reserve currency, has fallen to a three-year low as President Donald Trump ratchets up his attacks on Federal Reserve Chair Jerome Powell, calling him a “major loser” and demanding that he cut interest rates “NOW” to stimulate the American economy and stock market.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The U.S. dollar has declined 10% in the past three months and is hovering near its lowest level since the bear market of 2022 as President Trump threatens to fire the central bank governor. As the greenback, as the U.S. dollar is known, slides lower, the price of gold is hitting fresh records, rising above $3,400 per ounce for the very first time.

Gold, a safe haven asset in times of volatility, is now up nearly 30% on the year. Investors and markets have been upended by Trump’s ongoing attacks on the Federal Reserve, fearing that the central bank’s independence is being threatened. In early trading on April 21, all three major U.S. indices are in the red, with the Dow Jones Industrial Average down nearly 900 points.

“Preemptive Cuts”

Trump is calling on the Fed to make “preemptive cuts” to interest rates as markets and the U.S. economy reel from the president’s trade policies and high import tariffs. Trump has said on social media that there is “virtually no Inflation” in the U.S., and that costs for energy are declining. Trump called on “Mr. Too Late, a major loser,” referring to Jerome Powell to “lower interest rates NOW.”

Analysts and economists are warning that any attempt by Trump to fire Powell will lead to an even worse selloff in U.S. equity markets. Trump’s latest attacks on Powell come after the central banker said a week ago that tariffs will constrain growth and could fuel inflation, resulting in “stagflation” that is widely viewed as a central bank’s worst case scenario.

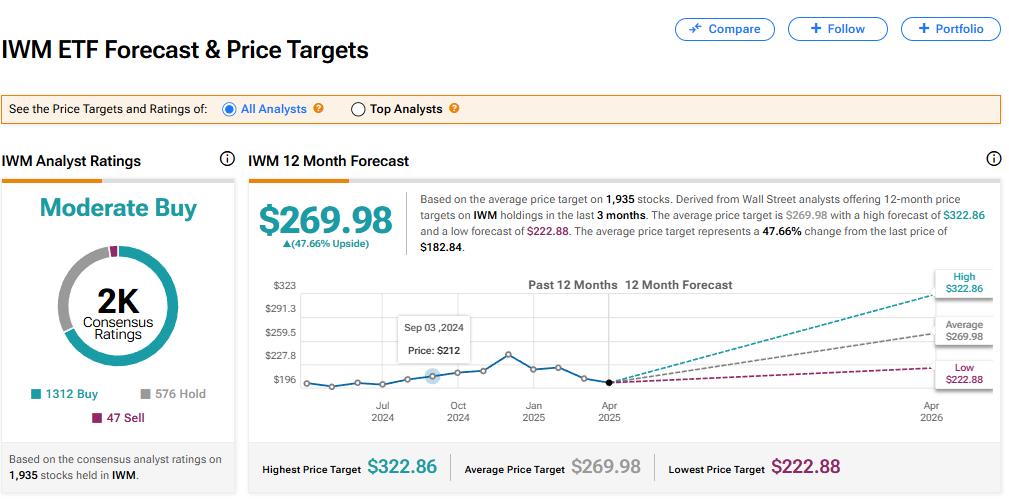

Is the iShares Russell 2000 ETF a Buy?

The iShares Russell 2000 exchange-traded fund (IWM) has a consensus Moderate Buy rating among 1,935 analysts on Wall Street. That rating is based on 1,312 Buy, 576 Hold, and 47 Sell recommendations assigned in the past three months. The average IWM price target of $269.98 implies 47.66% upside from current levels.